Unleashing Freedom: Permissionless Blockchain Platforms

Unleashing Freedom: Permissionless Blockchain Platforms

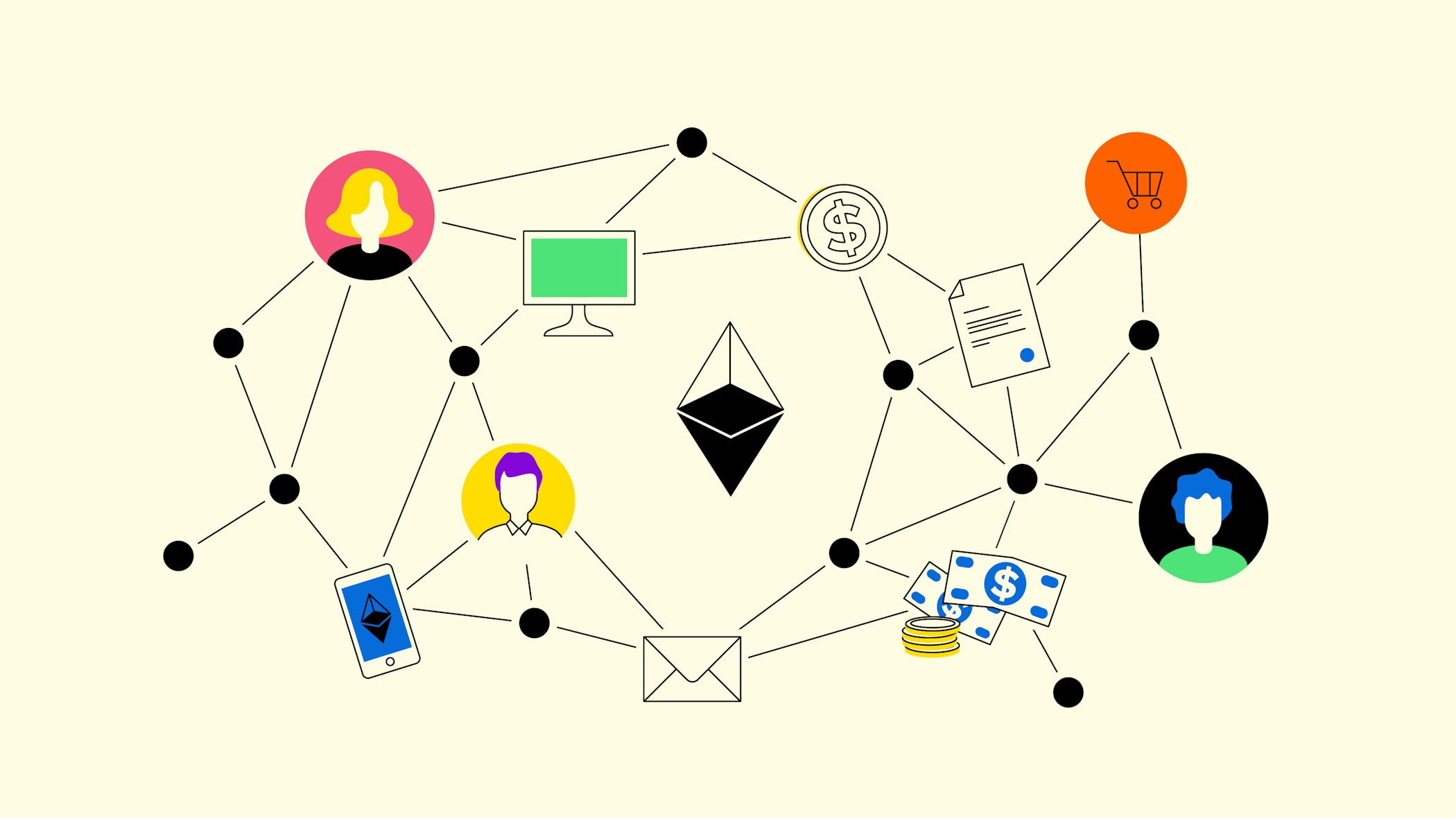

Blockchain technology, with its promise of decentralization and transparency, has given rise to permissionless blockchain platforms. These platforms, distinguished by their open participation and lack of centralized control, are transforming the way we envision and interact with digital ecosystems.

Defining Permissionless Blockchain: Breaking the Chains

Permissionless blockchains operate on the principle of inclusivity. Unlike permissioned counterparts that restrict participation to authorized entities, permissionless blockchains open their doors to anyone. This inclusivity eliminates gatekeepers, allowing individuals worldwide to participate, transact, and contribute to the blockchain network without seeking approval.

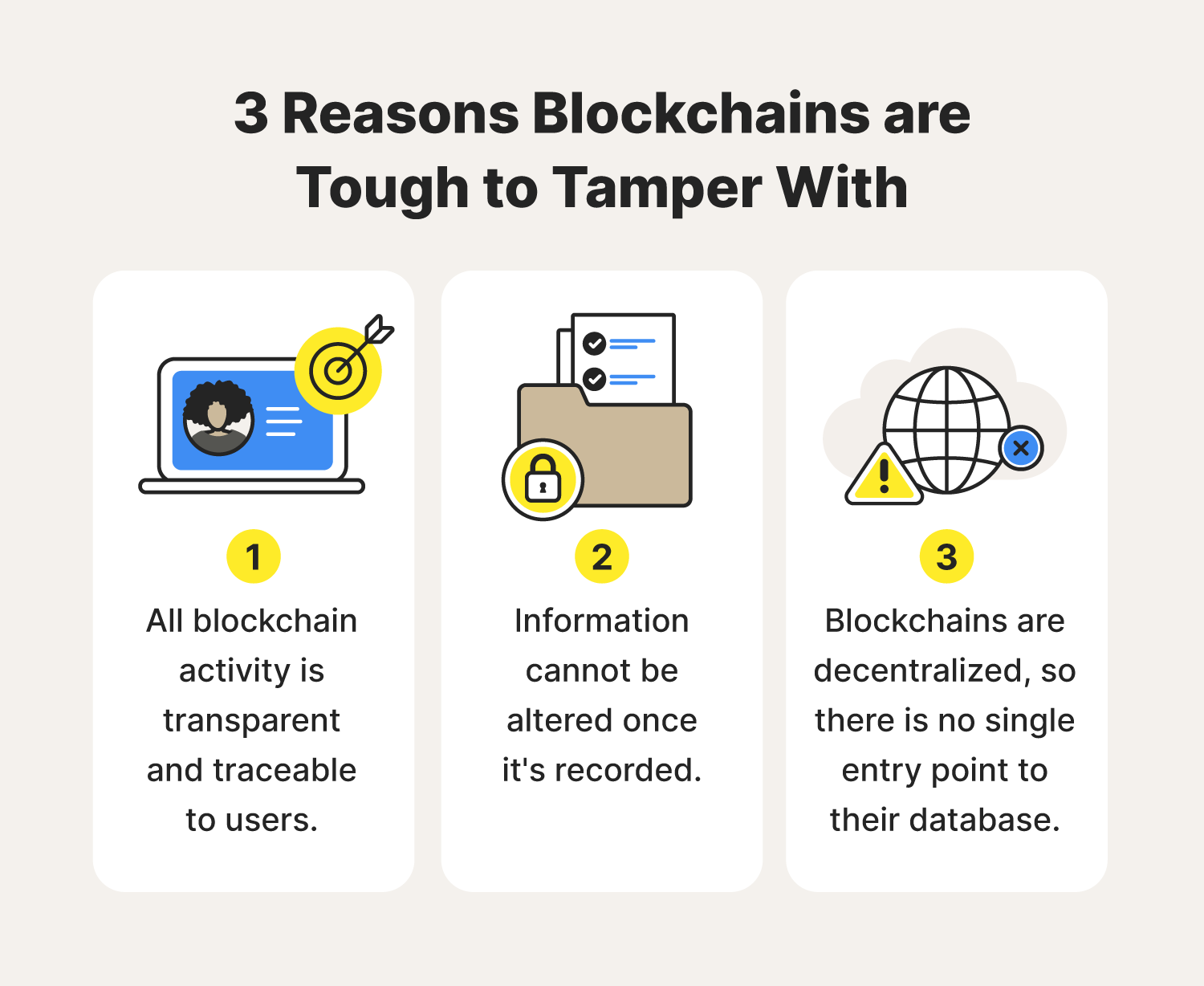

Decentralization at the Core: Redefining Trust

At the heart of permissionless blockchain platforms lies the concept of decentralization. Traditional systems rely on centralized authorities for trust, but permissionless blockchains distribute this trust across a network of nodes. This decentralization not only enhances security but also removes single points of failure, making the system more resilient and resistant to censorship.

Open Participation: Empowering Individuals

The permissionless nature of these platforms empowers individuals to be active participants in the network. Users can transact directly, engage in consensus mechanisms, and even propose changes to the protocol. This open participation fosters a sense of ownership and decentralizes control, creating a truly democratic digital environment.

Censorship Resistance: Preserving Freedom of Expression

One of the notable advantages of permissionless blockchain platforms is their resistance to censorship. Since no central authority governs these platforms, they become resistant to external censorship attempts. This characteristic is particularly crucial in regions where freedom of expression is under threat, providing a secure and unfiltered channel for communication and transaction.

Global Financial Inclusion: Banking the Unbanked

Permissionless blockchain platforms play a vital role in global financial inclusion. By removing barriers to entry, individuals without access to traditional banking systems can participate in financial activities. Cryptocurrencies built on permissionless blockchains become a means of financial inclusion, offering a decentralized alternative to conventional banking.

Smart Contracts: Executing Trustless Agreements

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, find a natural home in permissionless blockchain platforms. These contracts automate and enforce agreements without the need for intermediaries, adding efficiency and transparency to various sectors, from finance to supply chain management.

Challenges and Scalability: Navigating the Landscape

While permissionless blockchain platforms offer a myriad of benefits, they are not without challenges. Scalability remains a pressing issue, as increased user participation can strain network resources. Solutions and innovations, such as layer 2 scaling solutions and improved consensus algorithms, are actively being explored to address these challenges.

Evolving Consensus Mechanisms: Beyond Proof-of-Work

Permissionless blockchains have traditionally employed proof-of-work (PoW) as a consensus mechanism. However, the environmental impact of PoW has led to the exploration of alternative consensus mechanisms, such as proof-of-stake (PoS) and delegated proof-of-stake (DPoS). These mechanisms aim to maintain security while mitigating the energy consumption concerns associated with PoW.

The Future Landscape: Permissionless Innovation

Looking ahead, the future landscape of permissionless blockchain platforms is marked by ongoing innovation. Developers, communities, and enterprises continue to explore novel use cases and improve the efficiency and sustainability of these platforms. As technological advancements unfold, the permissionless model is expected to drive further innovation and reshape our digital interactions.

Conclusion: A Decentralized Tomorrow

In conclusion, permissionless blockchain platforms represent a cornerstone in the journey toward a decentralized future. By fostering inclusivity, decentralization, and global participation, these platforms empower individuals and redefine the way we transact and interact digitally. As the ecosystem continues to evolve, permissionless blockchain platforms stand as a beacon of innovation, paving the way for a more open and equitable digital world.

Explore more about Permissionless Blockchain Platforms here.