Decentralized Exchanges: Revolutionizing Blockchain Trading

Redefining Trading: The Impact of Decentralized Exchanges in Blockchain

The advent of decentralized exchanges (DEX) has brought a paradigm shift to the traditional landscape of blockchain trading. This article explores the transformative role of DEX platforms, their advantages, challenges, and their impact on the broader cryptocurrency ecosystem.

Understanding Decentralized Exchanges

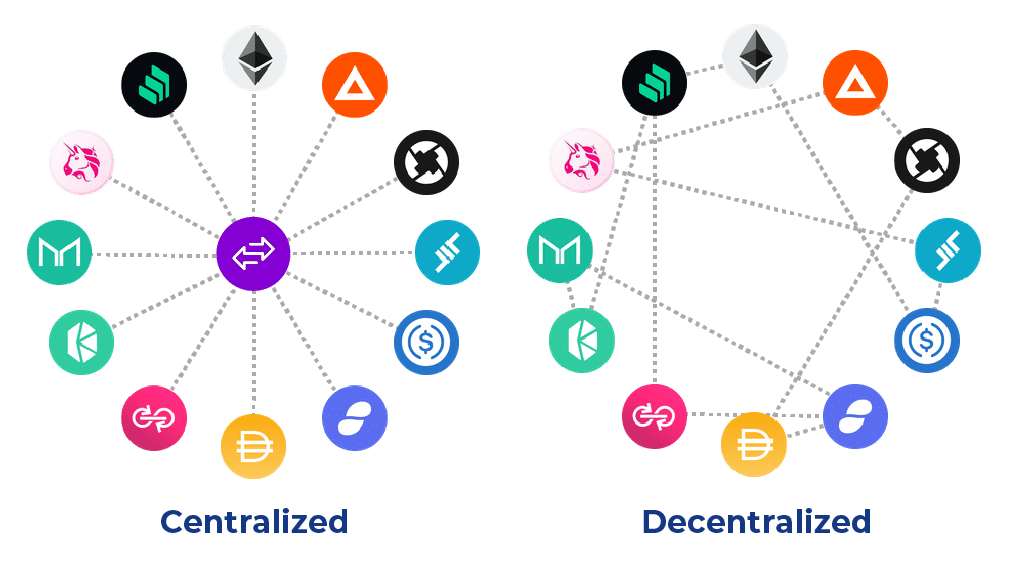

Decentralized exchanges operate without a central authority, allowing users to trade directly from their wallets without the need for an intermediary. This peer-to-peer approach aligns with the core principles of blockchain – decentralization, transparency, and security. DEX platforms leverage smart contracts to facilitate trustless trading, ensuring the integrity of transactions without relying on a third party.

Advantages of DEX Platforms

One of the key advantages of DEX platforms lies in user control. Users retain control of their private keys and funds throughout the trading process, eliminating the risk associated with centralized exchanges that hold custody of users’ assets. Additionally, the absence of a central authority reduces the likelihood of hacking or fraud, enhancing the overall security of the trading environment.

Enhanced Privacy and Anonymity

Privacy is a significant concern in the world of cryptocurrency, and DEX platforms address this by prioritizing user anonymity. Traders can engage in transactions without the need to register personal information, providing a level of privacy not typically offered by centralized exchanges. This feature resonates with users who prioritize maintaining their financial privacy.

Empowering Global Access

DEX platforms break down geographical barriers, allowing users from around the world to participate in trading without restrictions. This inclusive approach fosters global liquidity and a more diverse trading environment. Users can access a wide range of tokens and assets directly from their wallets, promoting financial inclusivity on a global scale.

Liquidity Challenges and Innovative Solutions

While DEX platforms offer numerous benefits, liquidity challenges have been a historical concern. Limited liquidity can impact the efficiency of trading and lead to higher slippage. However, innovative solutions, such as automated market makers (AMMs) and liquidity pools, have emerged to address these challenges. These mechanisms contribute to a more dynamic and liquid trading experience on DEX platforms.

Real-world Implementation: DEX Platforms in Action

For a firsthand look at how DEX platforms are revolutionizing blockchain trading, explore DEX Platforms in Blockchain. This platform provides insights into real-world examples and showcases the practical application and benefits of decentralized exchanges.

Regulatory Considerations and Challenges

As DEX platforms gain prominence, regulatory considerations come to the forefront. The decentralized and pseudonymous nature of these exchanges can pose challenges for regulators seeking to enforce compliance and prevent illicit activities. Striking a balance between regulatory requirements and the core principles of decentralization remains an ongoing challenge for the DEX ecosystem.

Interoperability and Cross-Chain Trading

Interoperability is a key focus for the future of DEX platforms. Enabling seamless transactions across different blockchains enhances the overall utility and flexibility of decentralized exchanges. Cross-chain trading capabilities are being explored and developed to allow users to trade assets from various blockchain networks without the need for centralized intermediaries.

User Education and Adoption

The success of DEX platforms depends on user education and adoption. As these platforms offer a different user experience compared to centralized exchanges, educating users about the advantages, risks, and functionalities of DEX is crucial. Efforts to improve user interfaces and provide user-friendly experiences contribute to broader adoption.

The Future of Decentralized Exchanges

In conclusion, DEX platforms play a pivotal role in reshaping the landscape of blockchain trading. Their emphasis on decentralization, enhanced privacy, and global accessibility align with the foundational principles of blockchain technology. As DEX platforms continue to innovate, address challenges, and gain wider adoption, they are likely to become a cornerstone of the decentralized financial ecosystem, offering users a secure and transparent alternative to centralized exchanges.