Tokenomics Unveiled: Navigating Blockchain Economics

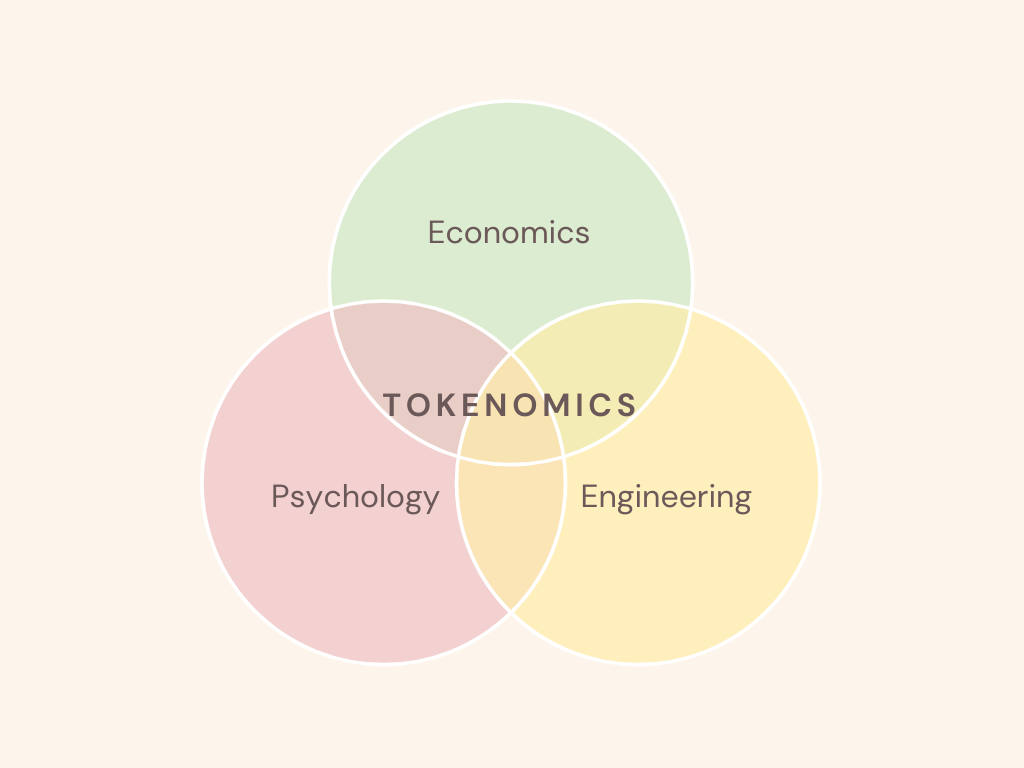

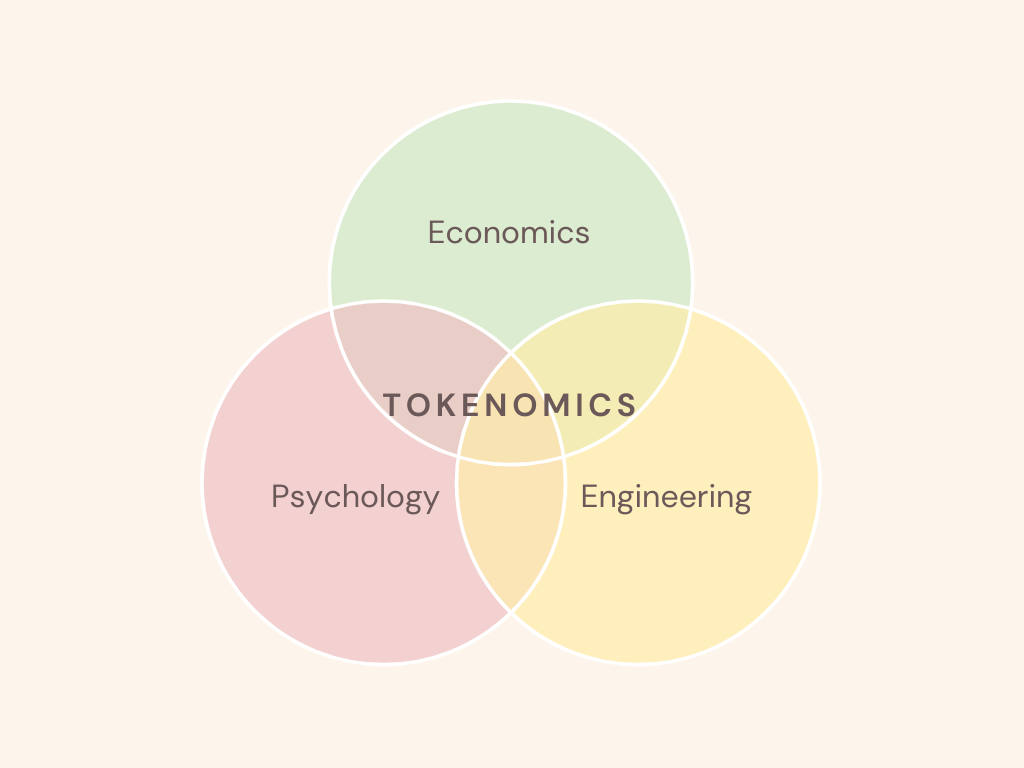

Blockchain technology introduces a novel economic paradigm through tokenomics, a term derived from “token” and “economics.” This article delves into the intricacies of tokenomics, exploring its components, impact on blockchain ecosystems, and its role in shaping the future of decentralized economies.

Understanding Tokenomics

Tokenomics refers to the economic system governing the creation, distribution, and utilization of tokens within a blockchain network. These tokens can represent various assets, rights, or utilities. Understanding tokenomics involves grasping the dynamics of token issuance, allocation, and the incentives driving participants within the blockchain ecosystem.

Components of Tokenomics

Tokenomics comprises several key components, each playing a distinct role. Token distribution mechanisms, consensus algorithms, and governance structures contribute to the overall design. Additionally, factors like token supply, utility, and the potential for scarcity influence the economic value of tokens. A well-designed tokenomics model aligns incentives, fosters participation, and enhances the overall functionality of a blockchain network.

Token Issuance and Distribution

The process of token issuance and distribution is a critical aspect of tokenomics. Initial Coin Offerings (ICOs), Security Token Offerings (STOs), and decentralized token launches are common methods. The distribution model determines how tokens are allocated among early investors, developers, users, and other stakeholders. A fair and transparent distribution mechanism is essential for establishing trust and credibility within the blockchain community.

Consensus Algorithms and Tokenomics

Consensus algorithms, such as Proof of Work (PoW) or Proof of Stake (PoS), are integral to tokenomics. They determine how nodes agree on the state of the blockchain and validate transactions. The chosen consensus algorithm influences the security, scalability, and energy efficiency of the network, thereby impacting the overall tokenomics model.

Governance Structures and Decision-Making

Governance structures define how decisions are made within a blockchain network. Decentralized Autonomous Organizations (DAOs) and on-chain governance models enable token holders to participate in decision-making processes. Effective governance ensures that the evolution of the blockchain aligns with the interests of its community, fostering a sense of ownership and inclusivity.

Token Utility and Scarcity

The utility of a token within the ecosystem contributes to its economic value. Tokens can serve various purposes, such as accessing platform features, participating in governance, or representing ownership. Scarcity, often achieved through limited token supply or burning mechanisms, can enhance token value. Balancing utility and scarcity is a delicate yet crucial aspect of successful tokenomics.

Impact on Blockchain Ecosystems

Tokenomics significantly impacts the dynamics of blockchain ecosystems. Well-designed tokenomics models incentivize network participation, attract developers, and create a vibrant community. The economic alignment fosters collaboration, innovation, and sustainability, contributing to the growth and resilience of the entire blockchain ecosystem.

Challenges and Criticisms

While tokenomics offers innovative solutions, it is not without challenges. Criticisms include potential market manipulation, unequal token distribution, and concerns about regulatory compliance. Addressing these challenges requires ongoing refinement of tokenomics models, transparent communication, and collaboration between blockchain projects and regulatory bodies.

Evolving Trends in Tokenomics

Tokenomics is a dynamic field, continually evolving to adapt to technological advancements and industry trends. Recent trends include the rise of decentralized finance (DeFi) tokens, non-fungible tokens (NFTs), and experiments with innovative consensus mechanisms. Staying informed about these trends is crucial for those navigating the ever-changing landscape of blockchain economics.

Tokenomics in Practice: Real-World Examples

Examining real-world examples provides insights into the practical application of tokenomics. Projects like Ethereum, Binance Coin (BNB), and Uniswap have distinct tokenomics models that have played pivotal roles in their success. Analyzing these cases offers valuable lessons for aspiring blockchain projects and enthusiasts.

Tokenomics in Blockchain Economics – Learn More

To delve deeper into Tokenomics in Blockchain Economics, visit fireboyandwatergirlplay.com. This comprehensive resource offers additional insights, tutorials, and updates on the latest developments in the world of tokenomics and its impact on decentralized economies.

In conclusion, tokenomics represents a fundamental shift in economic paradigms, introducing innovative ways to incentivize and align participants within blockchain ecosystems. As the field continues to mature, a thoughtful approach to designing and implementing tokenomics models is crucial for creating sustainable, inclusive, and resilient decentralized economies.