Decoding DAO Governance: Structures Shaping Decentralized Autonomy

Exploring the Foundations of DAO Governance Structures

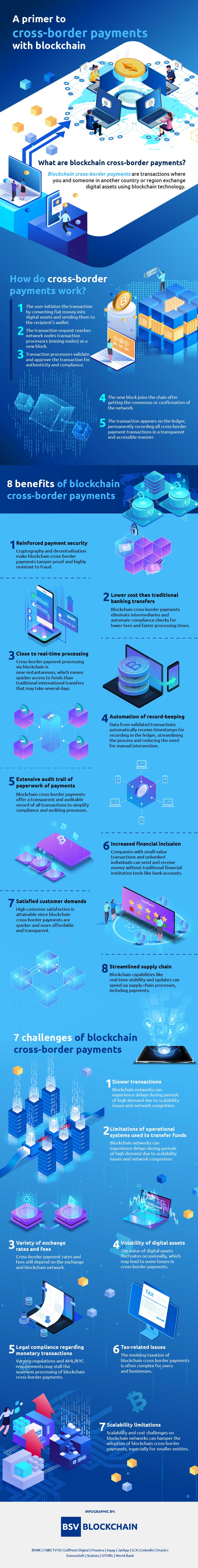

Decentralized Autonomous Organizations (DAOs) represent a novel approach to organizational governance, leveraging blockchain technology to create autonomous and transparent entities. Understanding the structures that govern DAOs is essential for grasping their transformative potential.

Defining DAO Governance

DAO governance encompasses the mechanisms and structures that dictate decision-making processes within a decentralized autonomous organization. Unlike traditional centralized entities, DAOs operate based on code and smart contracts, enabling stakeholders to participate in decision-making without the need for intermediaries.

Smart Contracts as the Backbone

At the core of DAO governance structures are smart contracts—self-executing pieces of code that automatically enforce the rules and processes defined within them. These contracts encode the governance protocols, ensuring that decisions, fund allocations, and other actions are executed as programmed.

Token-Based Voting Systems

DAOs often employ token-based voting systems as a key component of their governance structures. Token holders, representing stakeholders in the DAO, can cast votes proportional to their token holdings. This ensures a democratic decision-making process where more significant stakeholders have a commensurate influence on the outcomes.

Quadratic Voting and Reputation Systems

To address potential issues related to token concentration, some DAOs integrate quadratic voting or reputation systems into their governance structures. Quadratic voting assigns a non-linear relationship between the number of tokens and voting power, mitigating the influence of large token holders. Reputation systems allocate voting power based on contributors’ past actions and contributions to the DAO.

Multi-Sig Wallets and Security Measures

DAOs implement multi-signature wallets as security measures within their governance structures. These wallets require multiple private keys to authorize transactions, reducing the risk of unauthorized or malicious actions. Security is a paramount consideration in DAO governance to safeguard the assets and decisions of the decentralized organization.

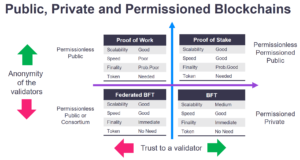

On-Chain Governance and Off-Chain Decision-Making

Governance structures in DAOs can be on-chain or off-chain. On-chain governance involves executing decisions directly on the blockchain through smart contracts, providing transparency and immutability. Off-chain decision-making may involve discussions and voting through other channels, with the final decision implemented on-chain.

Challenges in DAO Governance Structures

While DAO governance structures offer innovative solutions, challenges exist. Achieving consensus among diverse stakeholders, preventing collusion, and ensuring effective dispute resolution are ongoing concerns. DAOs must continually adapt their governance models to address these challenges and maintain the integrity of their decision-making processes.

Evolving Governance Models in DeFi

Decentralized Finance (DeFi) has been a driving force in the evolution of DAO governance structures. DeFi protocols often utilize DAOs for decision-making regarding protocol upgrades, fee structures, and asset listings. The experimentation within DeFi is contributing to the refinement of governance models that can be adopted across various decentralized applications.

Legal and Regulatory Considerations

As DAOs gain prominence, legal and regulatory considerations become increasingly important. Navigating the complex landscape of decentralized governance within existing legal frameworks poses challenges. DAOs are actively exploring ways to maintain their autonomy while adhering to applicable laws and regulations.

DAO Governance Structures: Shaping the Future of Collaboration

In summary, DAO governance structures represent a paradigm shift in organizational governance. By leveraging blockchain technology and innovative governance models, DAOs empower stakeholders to participate in decision-making processes, fostering a more inclusive and transparent approach to collaboration. The continuous evolution of DAO governance structures promises to shape the future of decentralized autonomy.

To delve deeper into the intricacies of DAO governance structures and their impact, explore DAO Governance Structures.

In conclusion, as DAOs continue to proliferate across various industries, understanding their governance structures is crucial. The dynamic interplay between smart contracts, token-based voting, and security measures defines how decentralized autonomous organizations operate. As DAOs become integral to the decentralized ecosystem, their governance structures will play a pivotal role in shaping the future of decentralized collaboration.