Empowering Minds: Blockchain Learning Platforms

Nurturing Expertise: Exploring Blockchain Education Platforms

Blockchain education platforms have emerged as transformative tools, empowering individuals to delve into the intricacies of blockchain technology. This article delves into the significance of these platforms, their features, and the role they play in fostering a knowledgeable and skilled blockchain community.

Bridging the Knowledge Gap: The Need for Blockchain Education

As blockchain technology continues to redefine industries, there is a growing need for individuals equipped with blockchain knowledge. Blockchain education platforms serve as bridges, closing the knowledge gap and empowering enthusiasts, students, and professionals to understand the nuances of distributed ledger technology.

Features of Blockchain Education Platforms

Blockchain education platforms offer a diverse array of features catering to learners of all levels. These features often include interactive courses, hands-on projects, real-world case studies, and assessments. Some platforms leverage gamification to enhance engagement, making the learning experience both informative and enjoyable.

Learning Paths: Tailoring Education to Individual Needs

Recognizing the diverse backgrounds and goals of learners, blockchain education platforms often provide customizable learning paths. Whether someone is a novice seeking foundational knowledge or an experienced developer aiming to specialize, these platforms offer curated paths that align with individual learning objectives.

Real-world Application: Blockchain Education Platforms in Action

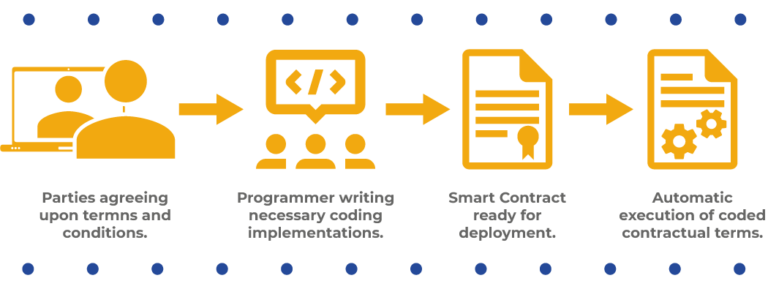

Explore Blockchain Education Platforms to witness real-world applications and examples of how these platforms are shaping the future of blockchain education. From introductory courses on blockchain fundamentals to advanced topics like smart contract development, this platform showcases the breadth and depth of educational opportunities.

Industry-Validated Certifications

Blockchain education platforms often collaborate with industry experts and organizations to offer certifications that validate the skills acquired through their courses. These certifications hold significance in the job market, providing learners with tangible proof of their blockchain proficiency.

Accessibility and Inclusivity

One of the strengths of blockchain education platforms is their accessibility. Learners from around the world can access courses, lectures, and resources at their own pace. This inclusivity breaks down geographical barriers, enabling a global community to engage in the shared pursuit of blockchain knowledge.

Continuous Updates: Staying Current in a Rapidly Evolving Field

Blockchain technology is dynamic, with constant advancements and updates. Recognizing this, education platforms regularly update their content to reflect the latest trends, tools, and best practices. This commitment to staying current ensures that learners receive relevant and up-to-date information.

Community Collaboration: Learning Beyond the Platform

Many blockchain education platforms foster a sense of community among learners. Discussion forums, collaborative projects, and networking opportunities enable individuals to learn not only from the platform’s resources but also from the experiences and insights of fellow learners and industry professionals.

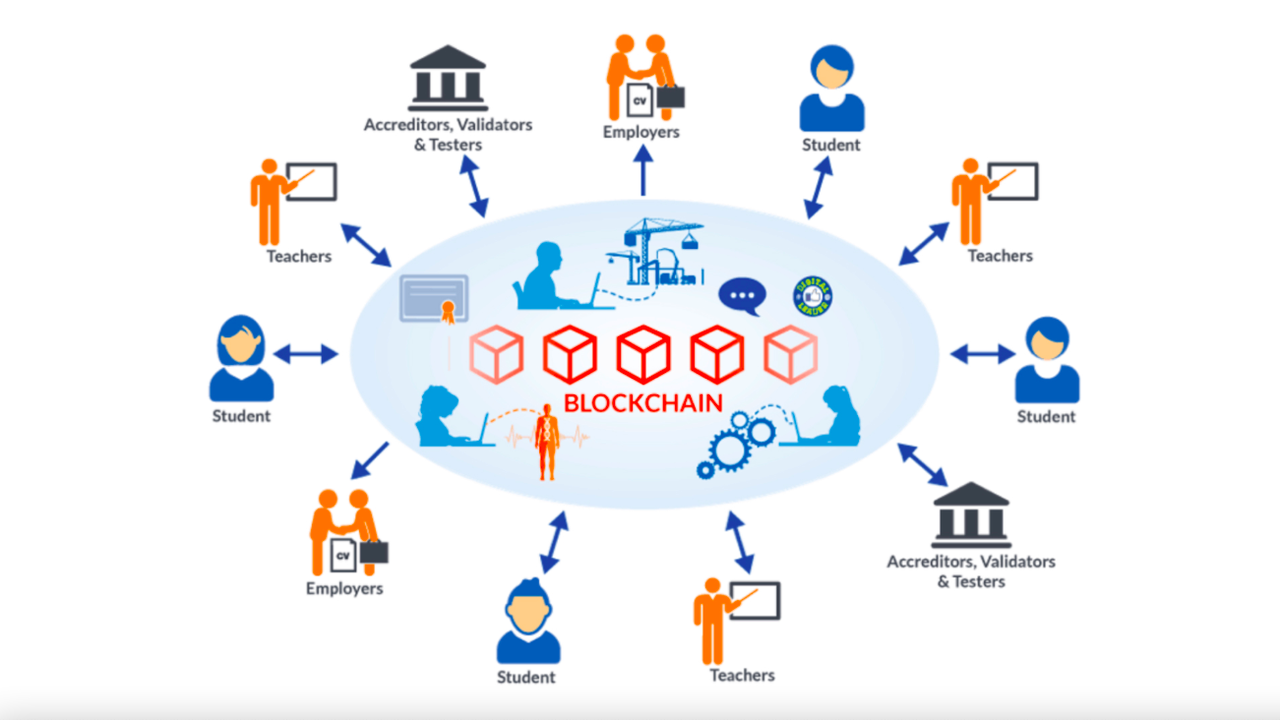

Bridging Academia and Industry: The Future of Blockchain Education

The evolution of blockchain education platforms signifies a broader trend—bridging the gap between academia and industry. As these platforms collaborate with industry leaders, they provide learners with insights into real-world applications and challenges, preparing them for meaningful contributions to the blockchain landscape.

Conclusion: Empowering the Future of Blockchain

In conclusion, blockchain education platforms play a vital role in shaping the future of blockchain technology. By providing accessible, engaging, and industry-relevant education, these platforms empower a new generation of blockchain enthusiasts and professionals. As the technology continues to evolve, the knowledge imparted through these platforms becomes a catalyst for innovation, driving the widespread adoption and integration of blockchain solutions across various sectors.