Token Standards: Unraveling ERC-20 and ERC-721 Dynamics

Understanding Token Standards: A Prelude

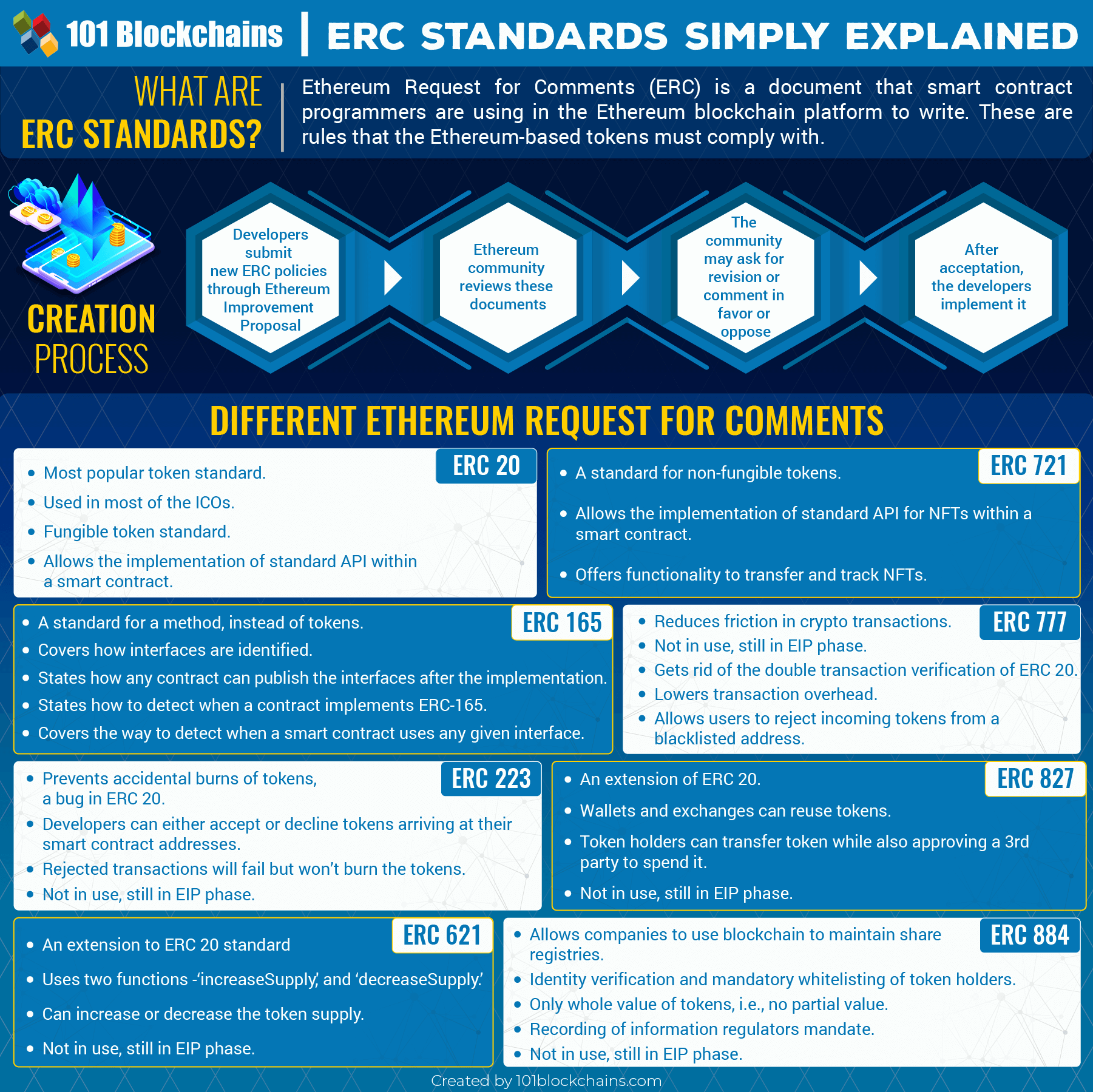

In the vast landscape of blockchain and cryptocurrencies, token standards play a pivotal role in shaping the functionalities and use cases of digital assets. Two widely recognized token standards, ERC-20 and ERC-721, have become cornerstones in the world of decentralized applications (DApps) and non-fungible tokens (NFTs), each offering distinct features and use cases.

ERC-20: The Foundation of Fungibility

ERC-20 stands as the most prevalent token standard on the Ethereum blockchain, providing a framework for fungible tokens. These tokens are interchangeable, meaning one unit is indistinguishable from another. Common use cases include utility tokens, representing assets like stablecoins and governance tokens, which rely on a shared set of rules and standards outlined by ERC-20.

ERC-721: Unleashing the Power of Non-Fungibility

In contrast to ERC-20, ERC-721 introduces non-fungible tokens, where each token is unique and holds specific information. This standard has gained immense popularity in the realm of digital art, collectibles, and gaming. Each ERC-721 token, such as an NFT, possesses individual characteristics, making it distinct and irreplaceable. This uniqueness has revolutionized ownership and provenance in the digital space.

Interoperability and Compatibility

One notable aspect of ERC-20 and ERC-721 standards is their interoperability within the Ethereum ecosystem. DApps and smart contracts can seamlessly interact with both types of tokens, providing developers with flexibility in designing diverse applications. This interoperability has fostered the creation of hybrid systems that harness the strengths of both standards to address specific needs.

The Rise of Tokenization

Tokenization, enabled by standards like ERC-20 and ERC-721, has extended beyond cryptocurrencies. Real-world assets, from real estate to art, are now being represented as tokens on blockchain networks. This democratization of asset ownership opens new avenues for fractional ownership, liquidity, and transparent transfer of value, illustrating the profound impact of token standards on various industries.

Challenges and Evolution

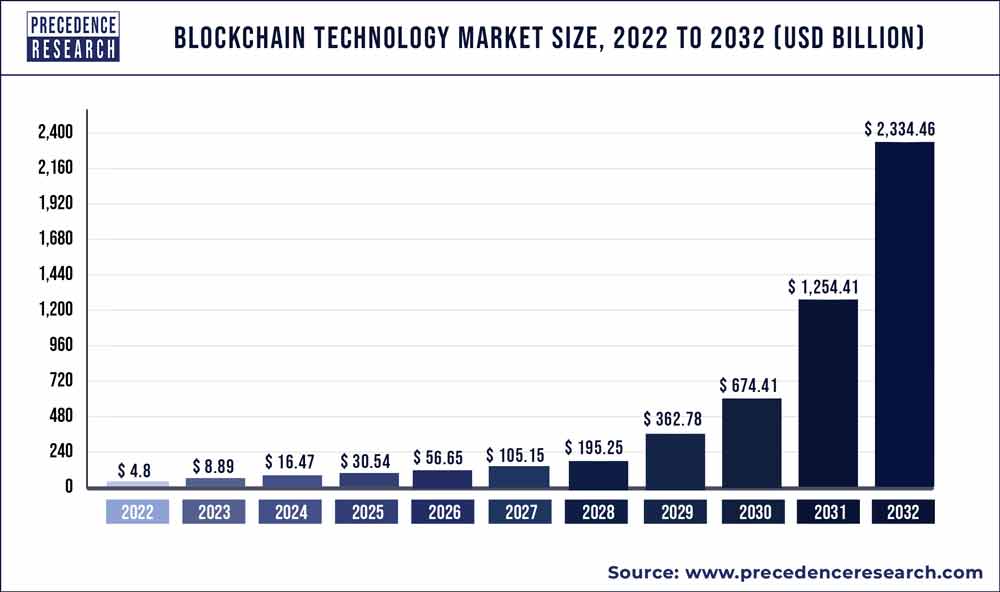

While ERC-20 and ERC-721 have significantly contributed to the blockchain space, they are not without challenges. Scalability issues and gas fees on the Ethereum network have prompted the exploration of alternative blockchains and token standards. The evolution of token standards continues, with ongoing research and development aiming to address these challenges and enhance the overall user experience.

Navigating the Tokenized Future

As blockchain technology advances, the role of token standards becomes even more critical. The emergence of standards like ERC-1155, designed to support both fungible and non-fungible tokens within a single contract, exemplifies the industry’s commitment to refining and expanding tokenization possibilities. Exploring the evolving landscape of token standards is key to navigating the tokenized future.

Realizing Potential: Token Standards in Action

To witness the dynamic impact of ERC-20 and ERC-721 standards, one need only explore the vibrant world of decentralized finance (DeFi) and the burgeoning NFT market. These standards underpin a multitude of applications, from decentralized exchanges to digital art platforms. Immerse yourself in the realm of Token Standards (ERC-20, ERC-721) at fireboyandwatergirlplay.com and witness the transformative potential of digital assets and ownership.

In conclusion, the journey through token standards, from the fungibility of ERC-20 to the uniqueness of ERC-721, unveils a captivating narrative of innovation and disruption. As the blockchain ecosystem continues to evolve, these standards will likely shape the future of digital value, ownership, and financial interactions in unprecedented ways.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/F5XNBUIGJFAR5BNZGXAWTZC5OM.jpg)