Aleph Crypto Exploring Decentralized Finance Solutions

Exploring the World of Aleph Crypto

Introduction

In the dynamic realm of cryptocurrency, Aleph Crypto has emerged as a significant player, offering innovative solutions and pushing the boundaries of blockchain technology. With its focus on security, decentralization, and user empowerment, Aleph Crypto is reshaping the landscape of digital finance.

Redefining Blockchain Innovation

At the heart of Aleph Crypto lies a commitment to redefining blockchain innovation. Unlike traditional cryptocurrencies, Aleph leverages advanced technology to ensure secure and efficient transactions. Its decentralized nature means that users have full control over their digital assets, without the need for intermediaries.

Empowering Financial Independence

One of the key principles of Aleph Crypto is empowering users with financial independence. By providing a platform that is accessible to anyone with an internet connection, Aleph aims to democratize finance and level the playing field for individuals worldwide. Whether you’re a seasoned investor or a newcomer to the world of cryptocurrency, Aleph offers tools and resources to help you navigate the digital economy with confidence.

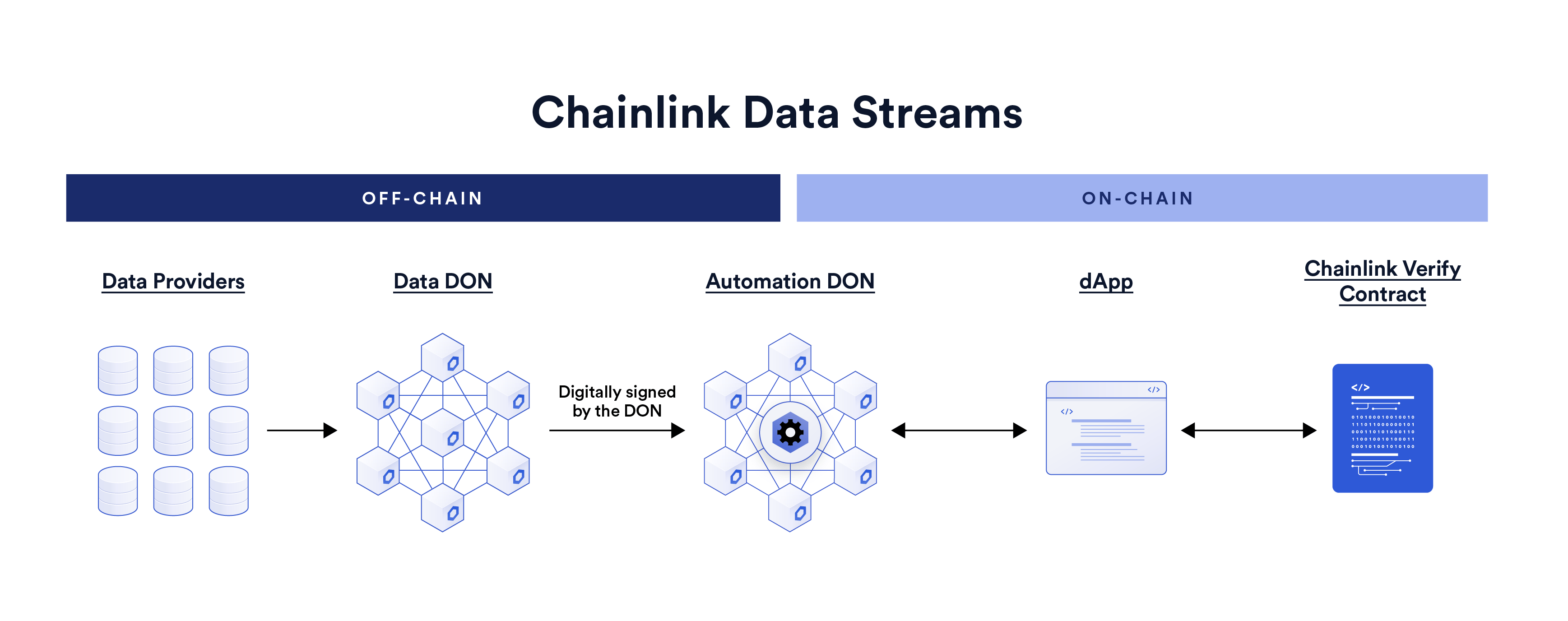

Advancing Decentralization

Decentralization is a cornerstone of Aleph Crypto’s philosophy. By removing central authorities from the equation, Aleph ensures that transactions are transparent, secure, and resistant to censorship. This decentralized approach not only enhances security but also fosters trust among users, who can rest assured that their assets are protected from manipulation or interference.

Securing Financial Transactions

Security is paramount in the world of cryptocurrency, and Aleph Crypto takes this responsibility seriously. Through its advanced encryption techniques and robust security protocols, Aleph safeguards users’ digital assets against theft, fraud, and hacking attempts. Whether you’re transferring funds or storing assets in a digital wallet, you can trust Aleph to keep your transactions secure.

Driving Innovation in Cryptocurrency Space

Aleph Crypto is not content to simply follow trends—it’s driving innovation in the cryptocurrency space. From its pioneering use of blockchain technology to its development of new financial instruments and services, Aleph is constantly pushing the boundaries of what’s possible in the digital economy. By fostering a culture of innovation and collaboration, Aleph aims to stay ahead of the curve and lead the way towards a more decentralized and inclusive financial future.

Shaping the Future of Digital Currency

As the world becomes increasingly digitized, the demand for secure and efficient digital currency solutions is only going to grow. Aleph Crypto is at the forefront of this evolution, shaping the future of digital currency with its innovative approach to blockchain technology. Whether it’s creating new financial products or exploring the potential of decentralized finance, Aleph is committed to pushing the boundaries of what’s possible in the world of cryptocurrency.

Redefining Transparency in Finance

Transparency is another core value of Aleph Crypto. By providing users with real-time access to transaction data and blockchain records, Aleph ensures that financial transactions are conducted openly and transparently. This transparency not only fosters trust among users but also helps to prevent fraud and abuse in the digital economy.

Embracing Decentralized Solutions

In a world dominated by centralized institutions and intermediaries, Aleph Crypto offers a refreshing alternative. By embracing decentralized solutions, Aleph empowers users to take control of their financial destiny and break free from the constraints of traditional finance. Whether it’s sending money to family members overseas or investing in emerging markets, Aleph provides the tools and infrastructure needed to navigate the digital economy with confidence.

Transforming Financial Paradigms

With its innovative approach to blockchain technology and commitment to user empowerment, Aleph Crypto is poised to transform financial paradigms and reshape the way we think about money. By democratizing access to financial services and providing secure and transparent digital currency solutions, Aleph is paving the way for a more inclusive and equitable financial future for all. Read more about aleph crypto

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/F5XNBUIGJFAR5BNZGXAWTZC5OM.jpg)