Tokenizing Blockchains: Standards for Digital Assets

Blockchain Tokenization Standards have become integral in shaping the landscape of digital assets, offering a framework for the creation, issuance, and management of tokens on blockchain networks. In this exploration, we delve into the significance of these standards, their impact on diverse industries, and the evolving role they play in the tokenization of real-world assets.

The Foundation of Blockchain Tokenization

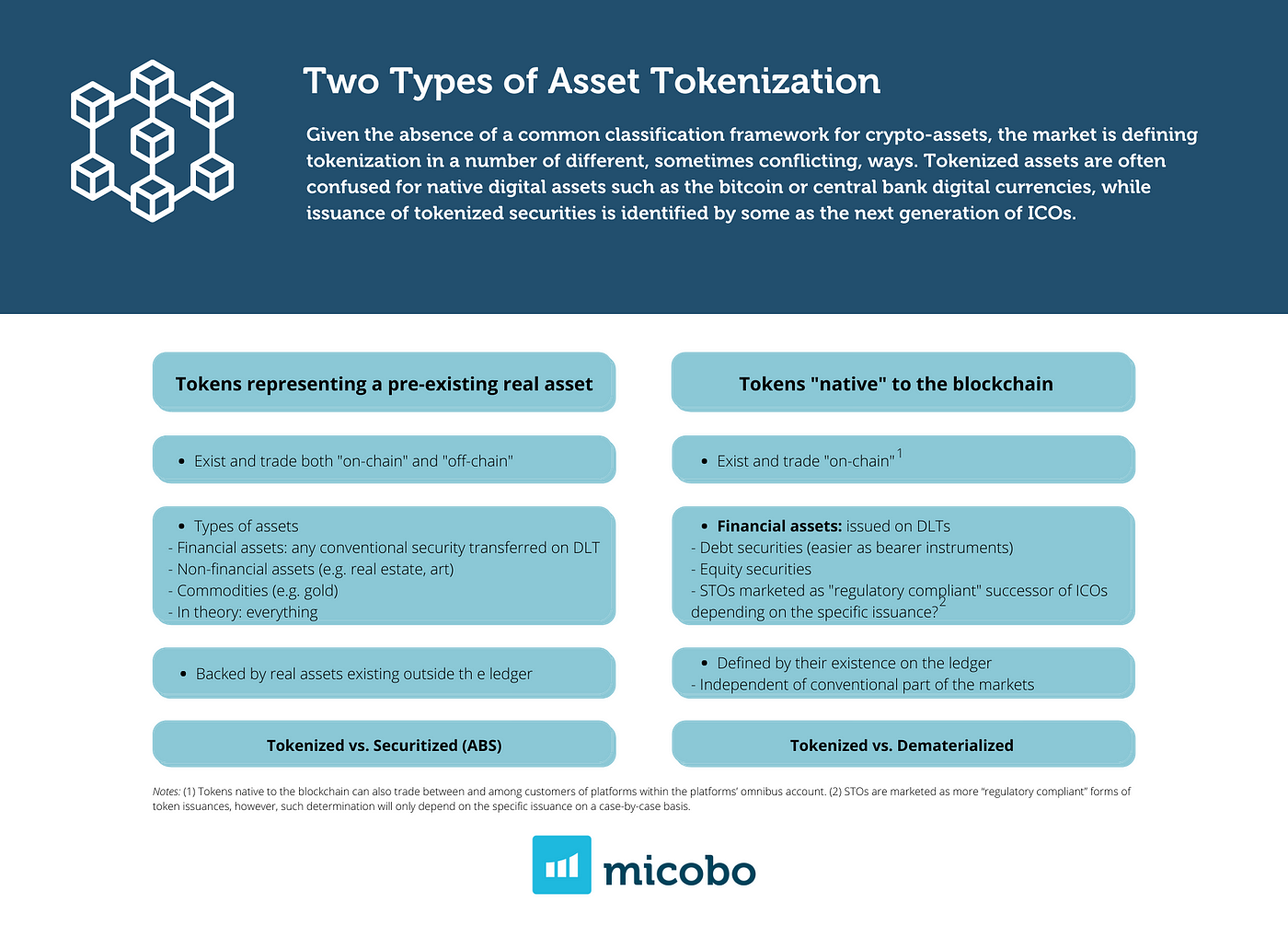

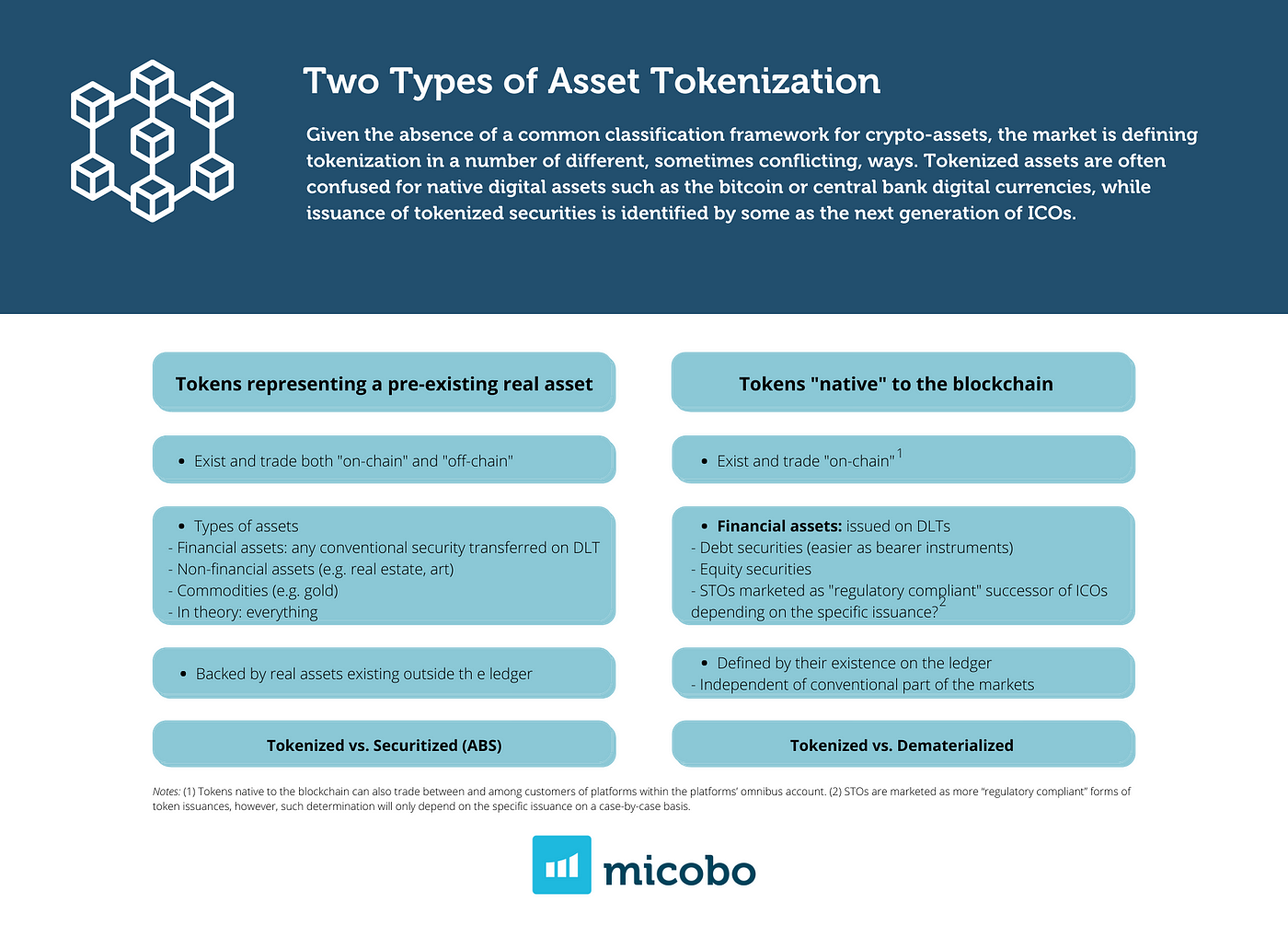

At its core, blockchain tokenization involves converting real-world assets into digital tokens on a blockchain. This process provides several benefits, including increased liquidity, fractional ownership, and enhanced transparency. Blockchain Tokenization Standards serve as the foundational guidelines that ensure interoperability and consistency across different tokenized assets, regardless of the blockchain network.

Interoperability Across Blockchain Networks

One of the key aspects of Blockchain Tokenization Standards is the emphasis on interoperability. As various blockchain networks coexist, standards enable tokens to move seamlessly between different platforms. This interoperability is crucial for fostering a unified and interconnected tokenized ecosystem, allowing users to transact and engage with assets across diverse blockchain infrastructures.

Security and Compliance Considerations

Blockchain Tokenization Standards address security and compliance concerns in the digital asset space. Standards define protocols for secure smart contract development, ensuring that tokenized assets adhere to best practices and are resistant to vulnerabilities. Additionally, compliance standards help align tokenized assets with regulatory requirements, promoting transparency and legal adherence within the evolving regulatory landscape.

Enhancing Liquidity and Accessibility

Tokenization standards play a pivotal role in enhancing liquidity and accessibility to a wide range of investors. By creating fungible tokens that can be easily traded on secondary markets, tokenization enables fractional ownership, making high-value assets accessible to a broader audience. This democratization of access to traditionally illiquid assets transforms the dynamics of investment and ownership.

Real-World Asset Tokenization

Blockchain Tokenization Standards extend their influence into the realm of real-world asset tokenization. These standards provide a structured approach to tokenize assets such as real estate, art, or even commodities. By representing ownership through blockchain tokens, the traditionally cumbersome processes of buying, selling, and transferring ownership of real-world assets become more efficient, transparent, and secure.

NFTs and Unique Digital Assets

While Blockchain Tokenization Standards often focus on fungible tokens, the rise of Non-Fungible Tokens (NFTs) represents another facet of digital asset tokenization. NFTs, governed by specific standards, tokenize unique digital assets, including digital art, music, and virtual real estate. These unique tokens leverage blockchain technology to establish ownership and provenance in the digital realm.

Decentralized Finance (DeFi) Integration

The integration of Blockchain Tokenization Standards intersects with the rapidly expanding ecosystem of Decentralized Finance (DeFi). Tokenized assets, governed by standards, can seamlessly integrate with various DeFi protocols, allowing users to leverage their tokenized holdings for lending, borrowing, and other financial activities within decentralized platforms.

Innovation in Tokenization Standards

The world of blockchain and digital assets is dynamic, and innovation within Blockchain Tokenization Standards continues to evolve. Emerging standards aim to address scalability, energy efficiency, and environmental concerns associated with certain blockchain networks. Additionally, efforts are underway to standardize the representation of off-chain assets on the blockchain, further expanding the scope of tokenization.

Challenges and Future Outlook

Despite the positive strides, challenges persist in the realm of Blockchain Tokenization Standards. These include navigating regulatory uncertainties, ensuring widespread adoption, and addressing potential security risks. The future outlook, however, remains optimistic as industry stakeholders collaborate to refine standards, tackle challenges, and unlock the full potential of tokenization across diverse sectors.

Evolving Tokenization Ecosystem

The evolving tokenization ecosystem, guided by robust Blockchain Tokenization Standards, continues to redefine the way we perceive and interact with assets. From real estate and commodities to digital art and unique collectibles, the tokenization of assets represents a paradigm shift in ownership, accessibility, and liquidity. As the ecosystem matures, the standards will play a crucial role in shaping a secure, interoperable, and innovative tokenized future.

To explore further on Blockchain Tokenization Standards, visit Blockchain Tokenization Standards.

In conclusion, Blockchain Tokenization Standards form the backbone of the digital asset revolution. By providing a standardized framework for creating and managing tokens on blockchain networks, these standards unlock new possibilities in finance, ownership, and accessibility. As the ecosystem continues to evolve, the impact of tokenization standards will extend into diverse industries, shaping the future of decentralized finance and ownership.