Token Standards Unveiled: Navigating Blockchain’s Framework

Token Standards Unveiled: Navigating Blockchain’s Framework

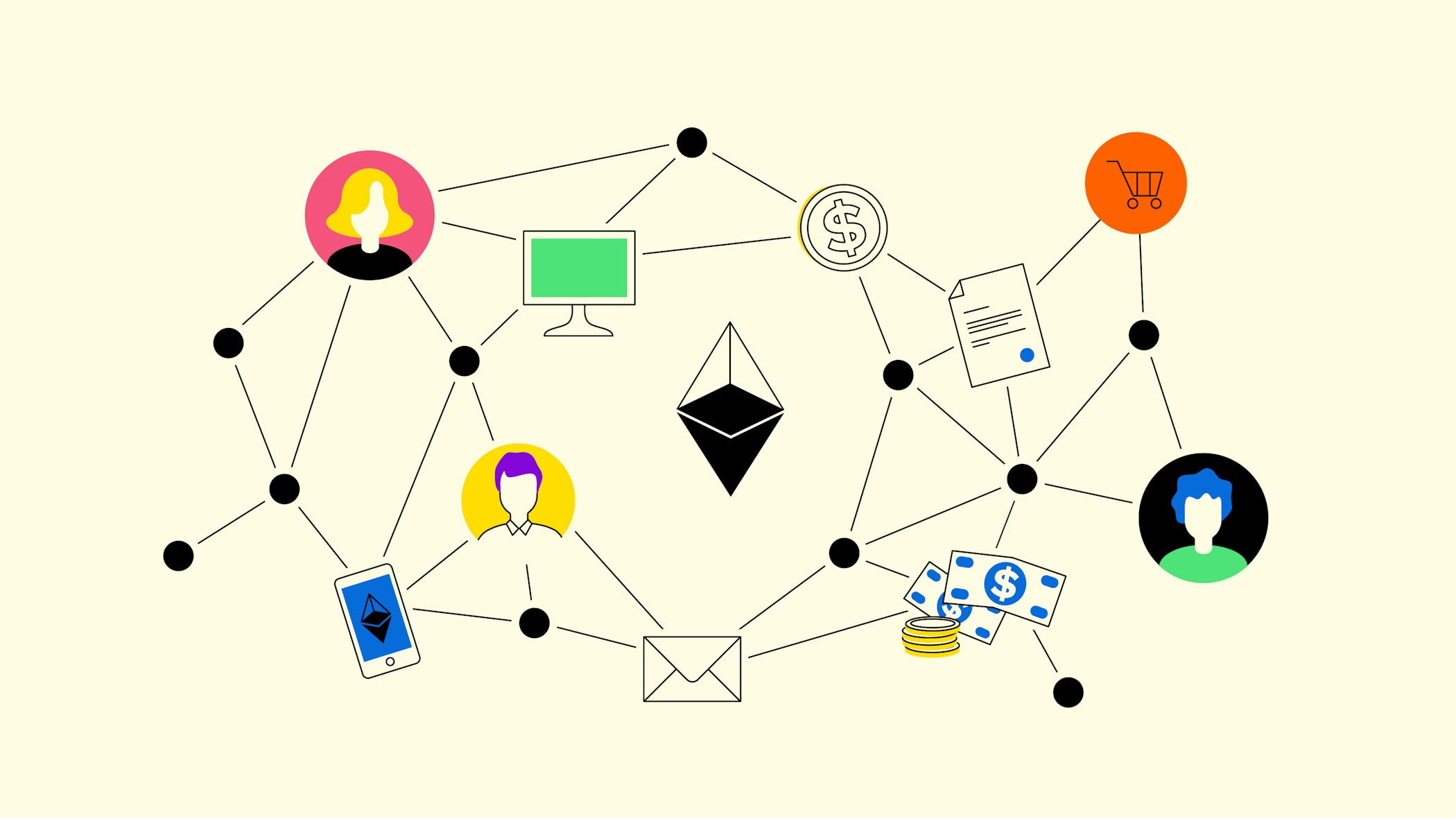

Blockchain technology has revolutionized various industries, introducing new possibilities and reshaping the way we perceive digital transactions. One key aspect driving this transformation is the implementation of token standards, which play a crucial role in defining and managing digital assets on the blockchain.

Understanding Token Standards

Token standards serve as a set of rules and protocols that dictate how tokens should be created, managed, and transferred on a blockchain. These standards ensure interoperability and compatibility, allowing different blockchain platforms to support and recognize tokens in a consistent manner. The two most common token standards are ERC-20 and ERC-721, each serving distinct purposes in the blockchain ecosystem.

ERC-20: The Foundation of Utility Tokens

The ERC-20 standard, short for Ethereum Request for Comment 20, has become the foundation for the majority of tokens on the Ethereum blockchain. This standard defines a set of rules that a token contract must follow, enabling the seamless creation and interaction of utility tokens. Utility tokens are integral to various decentralized applications (DApps), serving as a means of exchange within their ecosystems.

ERC-721: Pioneering Non-Fungible Tokens (NFTs)

In contrast to ERC-20, the ERC-721 standard focuses on non-fungible tokens (NFTs). NFTs represent unique assets that are indivisible and distinct from one another. This standard has gained immense popularity in the world of digital art, gaming, and collectibles, allowing for the creation and trade of unique digital assets on the blockchain.

Emerging Token Standards: Enhancing Blockchain Capabilities

As the blockchain space continues to evolve, new token standards are emerging to address specific use cases and enhance the capabilities of decentralized applications. These standards cater to diverse needs, including governance tokens, security tokens, and more. The development and adoption of these standards contribute to the maturation of the blockchain ecosystem.

Challenges and Solutions in Token Standardization

Despite the numerous advantages of token standards, challenges exist in achieving widespread adoption and standardization across various blockchain networks. Interoperability issues and divergent standards can hinder the seamless transfer of tokens between platforms. Efforts are underway to address these challenges, with projects working on cross-chain solutions and universal standards to foster a more interconnected blockchain landscape.

Token Standards in Action

To witness the impact and versatility of token standards in action, one needs to look no further than the booming NFT market. Digital artists, musicians, and creators are leveraging token standards like ERC-721 to tokenize their work, providing a transparent and immutable record of ownership. The NFT market exemplifies how token standards can revolutionize the traditional concepts of ownership and value in the digital realm.

For a deeper dive into the world of token standards and their role in shaping the future of blockchain, explore Token Standards in Blockchain.

Token Standards in Blockchain: Learn more about the evolving landscape of token standards and their impact on the blockchain ecosystem.

In conclusion, token standards are the backbone of blockchain functionality, enabling the creation and management of various digital assets. As the technology advances, these standards will continue to evolve, paving the way for new possibilities and applications across different industries. Understanding and embracing token standards is key to unlocking the full potential of blockchain technology.