American Express Metaverse Exploring Virtual Commerce

Exploring Virtual Commerce with American Express Metaverse

Venturing into the Virtual Realm

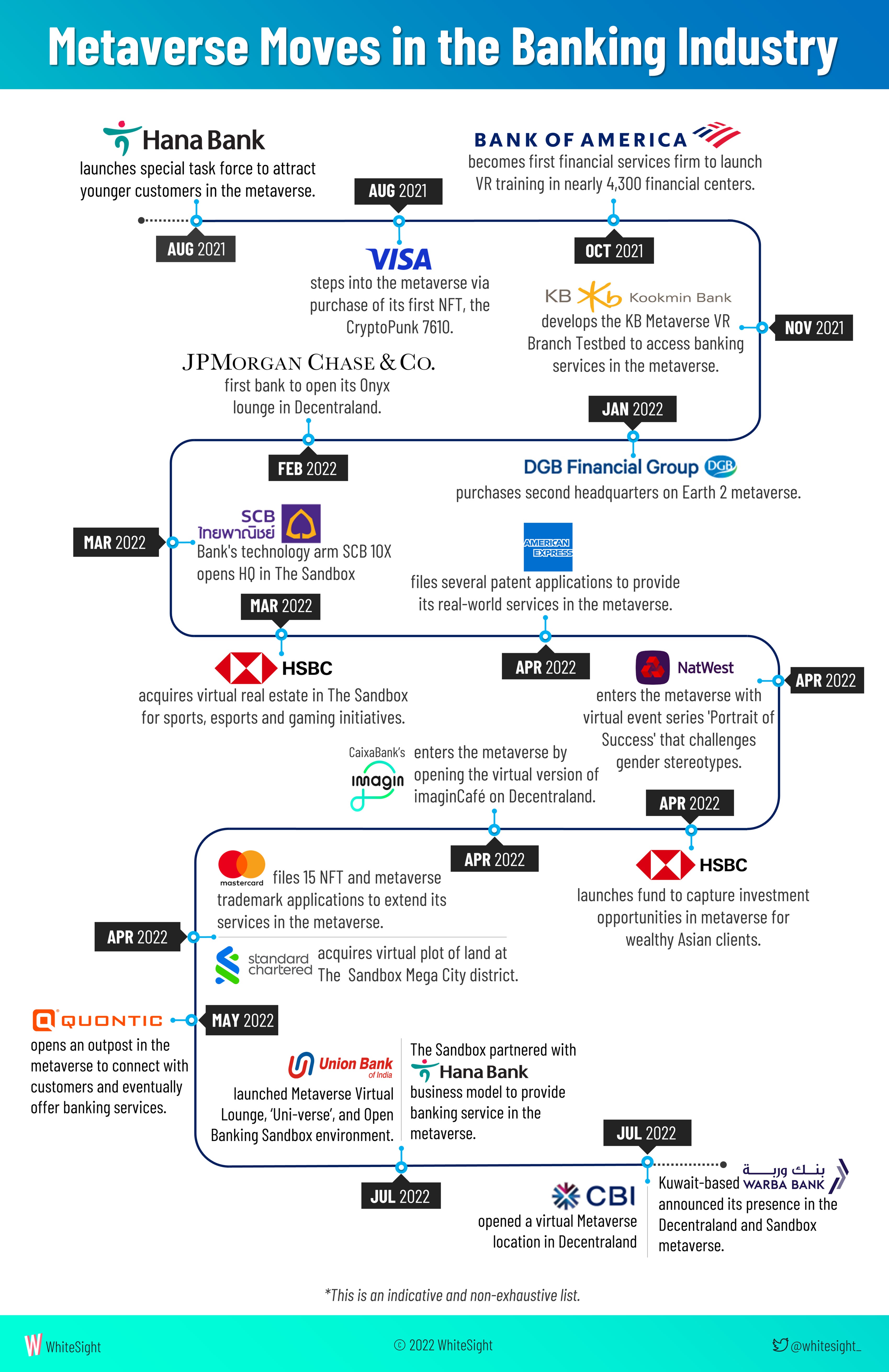

As the world continues its rapid digital transformation, traditional modes of commerce are evolving to meet the demands of a technologically savvy consumer base. In this dynamic landscape, American Express boldly steps into the realm of the metaverse, a virtual space where users can interact, transact, and explore in entirely new ways.

Embracing Innovation and Connectivity

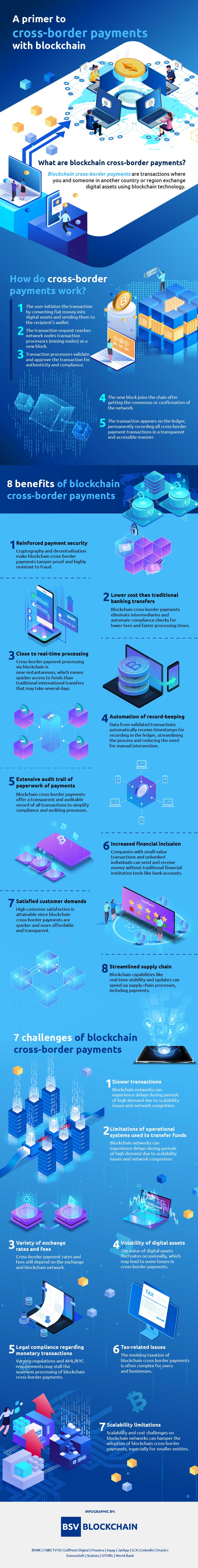

In the ever-expanding metaverse, innovation and connectivity reign supreme. American Express recognizes the potential of this virtual frontier to revolutionize the way people engage with financial transactions. By embracing cutting-edge technologies and forging partnerships within the metaverse ecosystem, American Express aims to provide seamless and secure payment solutions for users navigating this digital landscape.

Redefining the Shopping Experience

With its foray into the metaverse, American Express seeks to redefine the shopping experience for consumers worldwide. In this virtual realm, users can browse, purchase, and interact with products and services in immersive and engaging environments. By integrating its services seamlessly into the metaverse, American Express aims to empower users to make transactions with ease and confidence.

Navigating Virtual Transactions

As users navigate the intricacies of virtual transactions, security and trust become paramount concerns. American Express brings its decades-long expertise in financial services to the metaverse, offering users a trusted platform for conducting transactions. With robust security measures in place, users can rest assured that their financial information remains safe and secure in the virtual realm.

Pioneering Metaverse Commerce

American Express is at the forefront of pioneering metaverse commerce, leveraging its global presence and brand recognition to drive innovation in this emerging space. By collaborating with virtual platforms, content creators, and developers, American Express aims to create a seamless and integrated shopping experience for users across the metaverse.

Bridging Real and Virtual Worlds

In bridging the gap between the real and virtual worlds, American Express opens up new possibilities for users to engage with their finances. Whether making purchases in the physical world or exploring virtual marketplaces within the metaverse, users can rely on American Express to provide a consistent and reliable payment experience across both realms.

Empowering Users with Choice and Flexibility

In the metaverse, choice and flexibility are key drivers of user engagement. American Express recognizes the importance of offering users a wide range of payment options to suit their individual preferences and needs. From traditional credit and debit cards to digital wallets and cryptocurrency, American Express empowers users with the flexibility to choose how they want to transact in the virtual realm.

Shaping the Future of Payments

As American Express continues to innovate and expand its presence in the metaverse, the future of payments is being shaped in real-time. By embracing the possibilities of virtual commerce and leveraging its expertise in financial services, American Express is poised to play a leading role in shaping the future of payments in the digital age. Read more about american express metaverse