Unveiling 5IRE Token Revolutionizing Digital Transactions

Introducing 5IRE Token: A Gateway to Next-Gen Blockchain Solutions

Revolutionizing Digital Transactions

In the realm of digital transactions, the emergence of 5IRE Token has been nothing short of revolutionary. With its innovative features and capabilities, 5IRE Token is spearheading a new era in cryptocurrency. Unlike traditional forms of digital currency, 5IRE Token offers unparalleled security, efficiency, and versatility, making it the go-to choice for individuals and businesses alike.

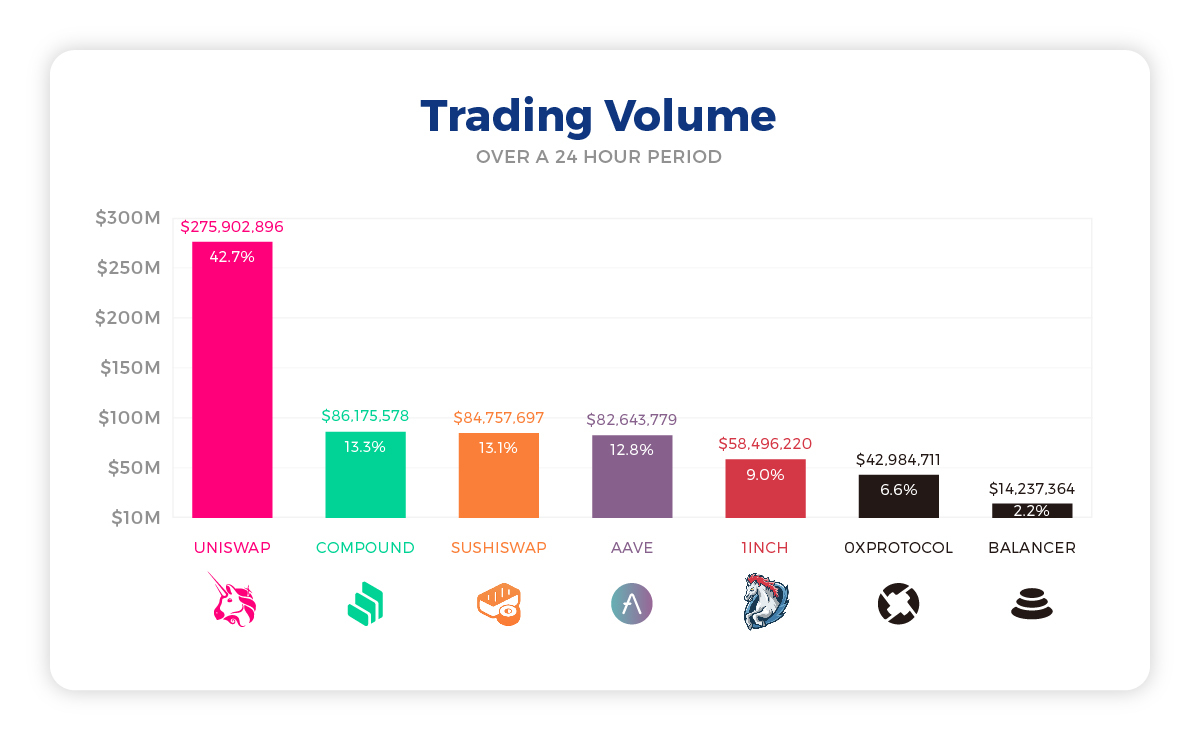

Exploring the Power of 5IRE Token in Decentralized Finance

Decentralized finance (DeFi) has gained significant traction in recent years, offering a range of financial services without the need for intermediaries. At the forefront of this movement is 5IRE Token, which serves as a fundamental building block for various DeFi applications. From lending and borrowing to decentralized exchanges, 5IRE Token plays a pivotal role in shaping the future of finance.

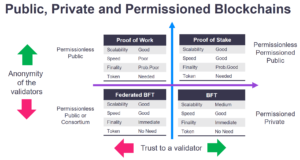

The Rise of 5IRE Token: Pioneering Innovation in Cryptocurrency

While the cryptocurrency market continues to evolve rapidly, few tokens have made as profound an impact as 5IRE Token. Its underlying technology, based on robust blockchain principles, ensures transparency, immutability, and trustlessness. As a result, 5IRE Token stands out as a beacon of innovation in an increasingly crowded digital landscape.

Empowering Transactions with 5IRE Token: A Game-Changer in Crypto

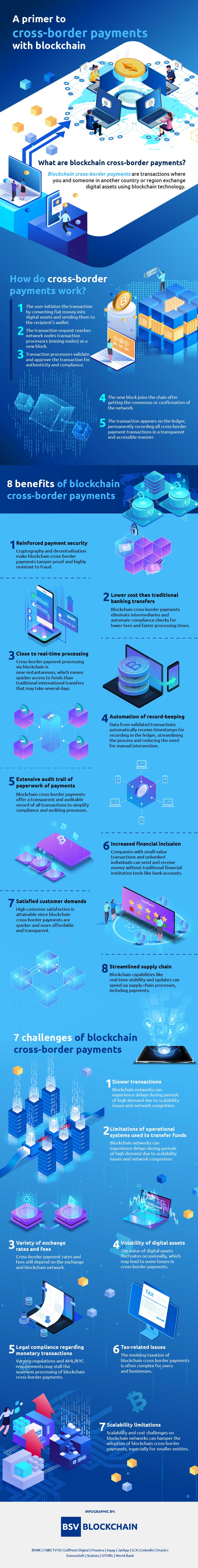

One of the key advantages of 5IRE Token lies in its ability to empower transactions like never before. Whether it’s sending funds across borders or conducting micropayments, 5IRE Token facilitates seamless and cost-effective transactions. Moreover, its decentralized nature eliminates the need for third-party intermediaries, ensuring faster processing times and lower fees.

Understanding the Potential of 5IRE Token in the Crypto Landscape

In a market characterized by volatility and uncertainty, 5IRE Token offers a sense of stability and reliability. Its value proposition extends beyond mere speculation, encompassing real-world utility and adoption. As more individuals and institutions recognize the potential of 5IRE Token, its influence within the crypto landscape continues to grow exponentially.

Harnessing the Benefits of 5IRE Token for Seamless Payments

One area where 5IRE Token truly shines is in facilitating seamless payments across borders and industries. Traditional payment methods are often fraught with inefficiencies and limitations, such as high fees and lengthy processing times. With 5IRE Token, users can enjoy near-instantaneous transactions at a fraction of the cost, regardless of geographical boundaries or banking hours.

Navigating the Future of Finance with 5IRE Token

As we navigate the complexities of an increasingly digital world, the role of 5IRE Token in shaping the future of finance cannot be overstated. Its innovative features, coupled with a robust ecosystem of applications, position it as a frontrunner in the race towards financial inclusion and empowerment. Whether it’s democratizing access to financial services or revolutionizing existing business models, 5IRE Token is paving the way for a more inclusive and equitable financial landscape.

5IRE Token: Redefining the Boundaries of Digital Currency

In redefining the boundaries of digital currency, 5IRE Token transcends the limitations of traditional monetary systems. Its decentralized nature ensures greater autonomy and control for users, while its underlying technology offers unparalleled security and transparency. By bridging the gap between traditional finance and blockchain innovation, 5IRE Token is reshaping our understanding of value exchange in the digital age.

Embracing the Efficiency of 5IRE Token in Financial Transactions

Efficiency is at the core of 5IRE Token’s value proposition, offering users a frictionless experience when it comes to financial transactions. Whether it’s executing smart contracts or settling payments in real-time, 5IRE Token streamlines processes that were once cumbersome and time-consuming. By embracing the efficiency of 5IRE Token, users can unlock new possibilities in how they manage and transfer value.

Unlocking Opportunities with 5IRE Token: Your Key to Crypto Success

For those looking to venture into the world of cryptocurrency, 5IRE Token represents a golden opportunity for success. Its robust infrastructure, coupled with a growing community of users and developers, provides a fertile ground for innovation and growth. Whether you’re a seasoned investor or a newcomer to the space, 5IRE Token offers the tools and resources you need to thrive in the ever-evolving crypto landscape.

Advancing Financial Inclusion with 5IRE Token

Financial inclusion remains a pressing issue in many parts of the world, with billions of people still lacking access to basic banking services. 5IRE Token seeks to address this challenge by providing a decentralized platform for financial empowerment. By eliminating barriers to entry and promoting accessibility, 5IRE Token is leveling the playing field and opening up new opportunities for individuals and communities around the globe.

Embracing Innovation: The Story of 5IRE Token

At its core, the story of 5IRE Token is one of relentless innovation and progress. From its humble beginnings to its current status as a leader in the crypto space, 5IRE Token has never wavered in its pursuit of excellence. By embracing innovation at every turn, 5IRE Token continues to push