Transforming Digital Finance: Introduction to Cryptocurrency Blockchain Platforms

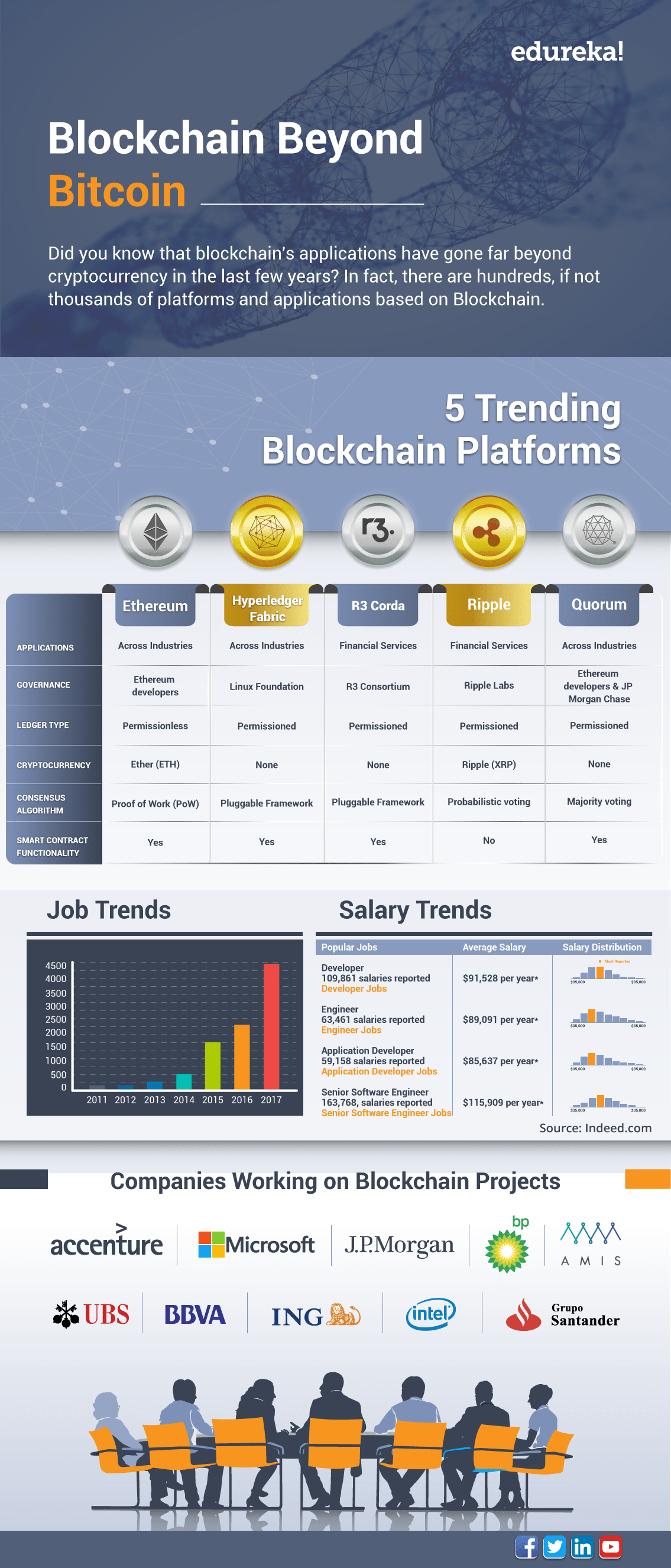

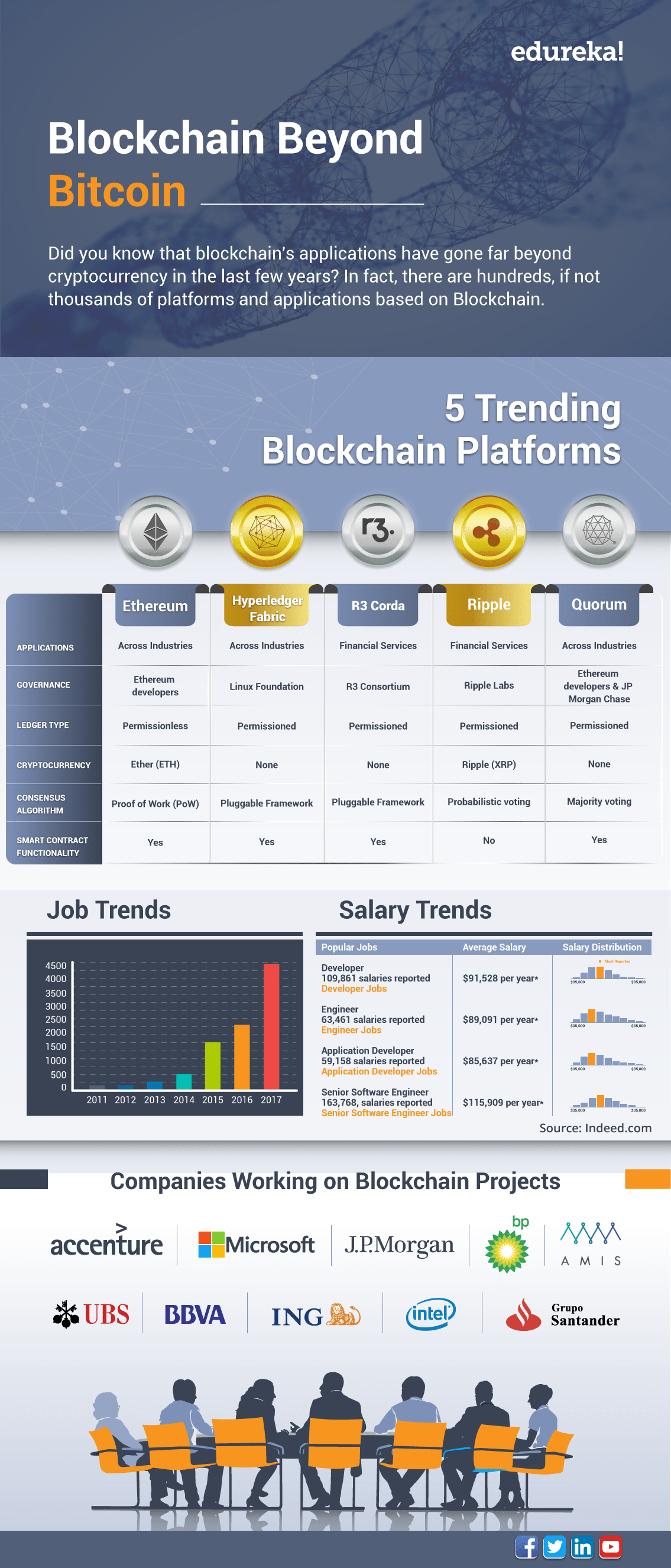

Cryptocurrency blockchain platforms have become synonymous with the evolution of digital finance, offering innovative solutions and reshaping the landscape of online transactions. In this exploration, we delve into the key aspects, functionalities, and the profound impact of cryptocurrency blockchain platforms on the way we perceive and engage with financial systems.

The Foundation: Understanding the Blockchain Technology

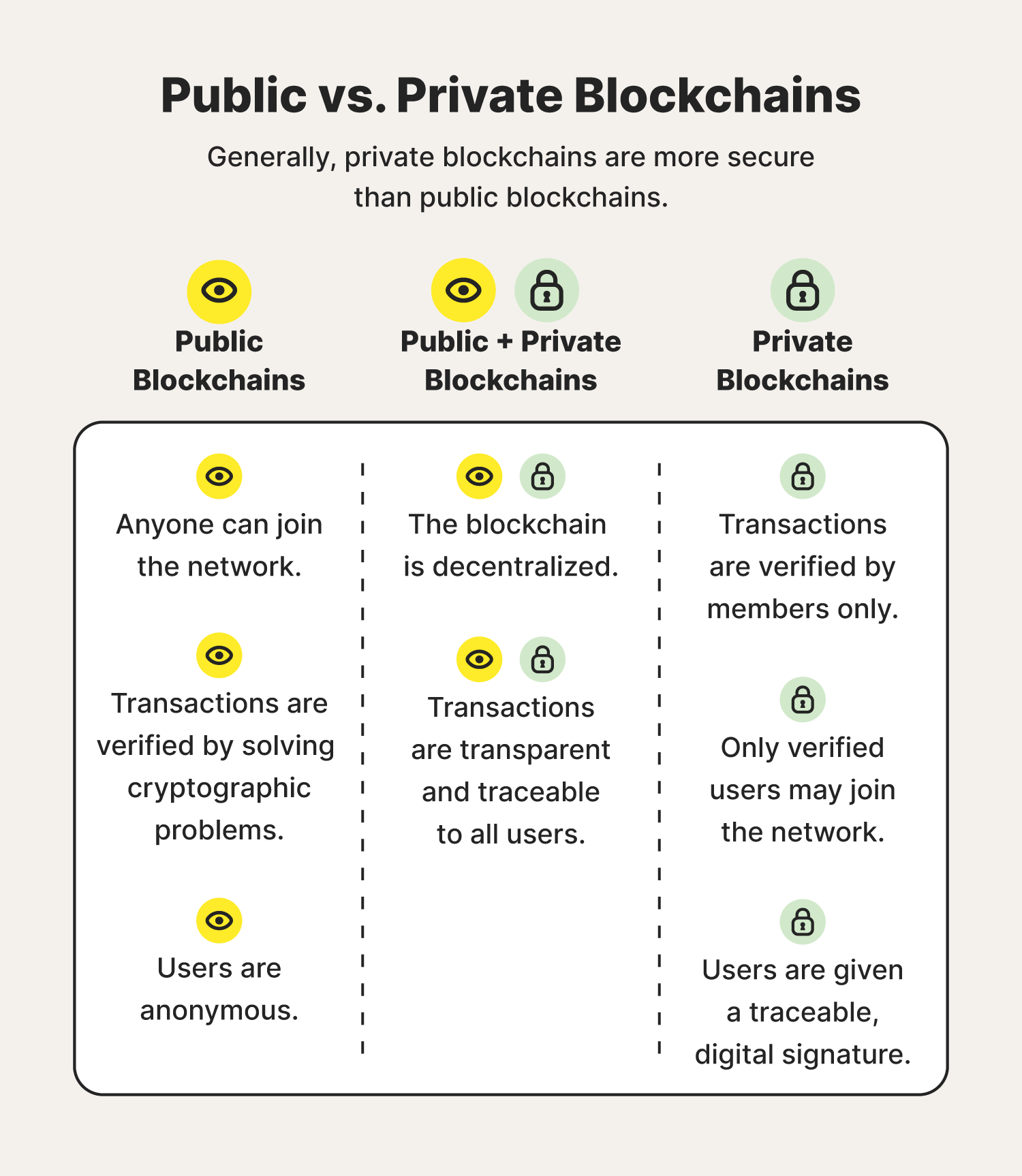

At the heart of cryptocurrency blockchain platforms lies the revolutionary technology of blockchain. This decentralized and distributed ledger system ensures transparency, security, and immutability of transactions. Each block in the chain contains a record of transactions, linked and secured through cryptographic hashes. This foundational technology eliminates the need for intermediaries, providing a peer-to-peer system for secure and efficient financial transactions.

Cryptocurrencies as Native Assets: Beyond Traditional Currencies

Cryptocurrency blockchain platforms operate with their native digital currencies. These cryptocurrencies serve as the fuel powering the underlying blockchain network. Bitcoin, Ethereum, and numerous altcoins are examples of these digital assets, each designed with specific use cases and functionalities. As native assets, these cryptocurrencies enable seamless and borderless financial transactions, transcending the limitations of traditional fiat currencies.

Smart Contracts: Executing Programmable Financial Agreements

One of the distinguishing features of cryptocurrency blockchain platforms is the integration of smart contracts. Smart contracts are self-executing agreements with predefined rules and conditions. These programmable financial agreements automate and enforce the terms of a contract without the need for intermediaries. This innovation has far-reaching implications, from decentralized finance (DeFi) applications to the tokenization of assets.

Decentralized Finance (DeFi): Redefining Financial Services

Cryptocurrency blockchain platforms play a pivotal role in the rise of decentralized finance (DeFi). DeFi leverages blockchain technology to recreate traditional financial services, such as lending, borrowing, and trading, without the need for traditional intermediaries like banks. This decentralized approach provides users with greater control over their assets, access to global financial markets, and the opportunity to earn through various yield farming and liquidity provision mechanisms.

Tokenization of Assets: Real-World Assets on the Blockchain

Another groundbreaking aspect of cryptocurrency blockchain platforms is the tokenization of real-world assets. Through the creation of digital tokens representing ownership or rights to physical assets, blockchain platforms enable fractional ownership, increased liquidity, and enhanced accessibility to a wide range of assets such as real estate, art, and even commodities.

Interoperability: Connecting Blockchain Networks

As the cryptocurrency ecosystem expands, the need for interoperability between different blockchain networks becomes apparent. Cryptocurrency blockchain platforms are actively working on solutions to enhance interoperability, allowing seamless communication and transactions between disparate blockchain networks. This interoperability is crucial for the continued growth and evolution of the broader cryptocurrency space.

Challenges and Regulatory Considerations: Navigating the Cryptocurrency Landscape

While cryptocurrency blockchain platforms offer transformative solutions, they are not without challenges. Regulatory uncertainties, security concerns, and scalability issues are among the hurdles that the cryptocurrency industry faces. Navigating these challenges requires collaboration between industry participants, regulators, and developers to establish a robust and sustainable framework for the future of digital finance.

The Rise of NFTs: Tokenizing Digital Assets

Non-fungible tokens (NFTs) represent a unique intersection of cryptocurrency and digital art, gaming, and collectibles. Cryptocurrency blockchain platforms facilitate the creation and trading of NFTs, providing a secure and transparent platform for artists, gamers, and enthusiasts to tokenize and exchange digital assets in a global marketplace.

Cryptocurrency Blockchain Platforms in Action: Experience the Future

To actively engage with the transformative power of cryptocurrency blockchain platforms, users can explore platforms exemplifying these principles. Cryptocurrency Blockchain Platforms provide an interactive environment for users to delve into the features and functionalities of these platforms, offering a firsthand experience of the future of digital finance.

Conclusion: Shaping the Future of Digital Finance

In conclusion, cryptocurrency blockchain platforms are at the forefront of reshaping the landscape of digital finance. From the foundational technology of blockchain to the innovative applications of smart contracts, DeFi, tokenization, and NFTs, these platforms continue to drive the evolution of the financial industry. As users navigate this digital frontier, the transformative potential of cryptocurrency blockchain platforms offers a glimpse into the future of borderless, inclusive, and programmable finance.