DEX Platforms in Blockchain: Decentralizing Digital Asset Trading

Introduction

Decentralized exchanges (DEX) have become a focal point in the blockchain space, reshaping the landscape of digital asset trading. In this article, we explore the dynamics of DEX Platforms in Blockchain, their significance, and the impact they bring to the world of cryptocurrency trading.

The Rise of Decentralized Exchanges

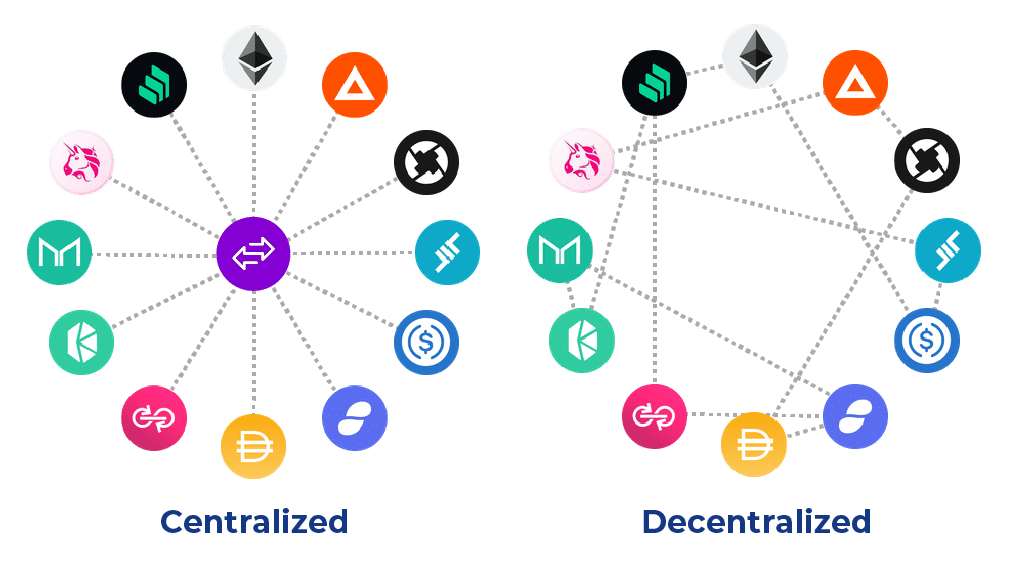

Decentralized exchanges represent a departure from traditional centralized exchanges by eliminating the need for intermediaries. These platforms operate on blockchain technology, enabling users to trade digital assets directly without relying on a centralized authority. The rise of DEX platforms is fueled by the desire for increased security, privacy, and control over one’s assets.

Key Characteristics of DEX Platforms

DEX platforms share common characteristics that set them apart from their centralized counterparts. They operate on blockchain networks, utilize smart contracts for trading, and allow users to retain ownership of their private keys. The absence of a central authority in DEX platforms contributes to enhanced security, censorship resistance, and transparency in the trading process.

Smart Contracts Facilitating Trustless Trading

Smart contracts play a pivotal role in DEX platforms by automating the execution of trades without the need for an intermediary. These self-executing contracts enforce the terms of the trade, ensuring that assets are exchanged only when predefined conditions are met. Trustless trading becomes a reality as smart contracts eliminate counterparty risk and establish a transparent and secure trading environment.

Types of DEX Platforms

There are various types of DEX platforms, each with its unique approach to facilitating decentralized trading. Automated Market Makers (AMMs), order book-based DEX, and decentralized finance (DeFi) platforms are among the prevalent categories. Each type addresses specific trading preferences and requirements, providing users with diverse options for engaging in decentralized asset exchanges.

Benefits of DEX Platforms

The benefits of using DEX platforms are multifaceted. Users enjoy increased security as they retain control of their private keys. Additionally, DEX platforms often have lower fees compared to centralized exchanges, fostering a cost-effective trading environment. The absence of a central authority reduces the risk of hacking and ensures that users maintain ownership of their assets throughout the trading process.

To explore more about DEX Platforms in Blockchain, visit fireboyandwatergirlplay.com. This resource offers valuable insights, discussions, and community resources on the latest trends and developments in decentralized exchanges.

Challenges and Considerations

While DEX platforms bring significant advantages, they are not without challenges. Liquidity, user experience, and the integration of real-world assets into decentralized trading environments are aspects that continue to be addressed by ongoing developments in the DEX space. Overcoming these challenges is essential for the continued growth and adoption of decentralized exchanges.

Regulatory Landscape and Compliance

The regulatory landscape surrounding DEX platforms is evolving. Compliance with regulatory requirements is a crucial consideration for the sustainable growth of decentralized exchanges. Some DEX platforms are actively working on incorporating compliance features while preserving the core principles of decentralization and user privacy.

Interoperability and Integration

Interoperability is a key consideration for the broader adoption of DEX platforms. Efforts to enhance interoperability involve enabling seamless communication between different blockchain networks and allowing users to trade assets across multiple platforms. Integration with external wallets and blockchain protocols further contributes to a more interconnected and user-friendly DEX ecosystem.

Innovation and Future Trends

The DEX space is marked by continuous innovation. Layer 2 solutions, decentralized oracles, and novel consensus mechanisms are among the areas where ongoing research and development are pushing the boundaries of what is possible in decentralized trading. The future holds exciting prospects as DEX platforms evolve to meet the growing demands of the blockchain community.

Conclusion

DEX Platforms in Blockchain represent a transformative force in the world of digital asset trading. By decentralizing exchanges, these platforms empower users with increased control, security, and transparency in their transactions. The ongoing developments, challenges, and innovations in the DEX space underscore the dynamic nature of this sector, shaping the future of decentralized finance and digital asset trading.