Tokenizing Possibilities: Exploring Blockchain Tokenization Platforms

Unlocking Opportunities: Exploring the World of Blockchain Tokenization Platforms

Blockchain tokenization platforms are at the forefront of transforming traditional assets into digital tokens, providing new avenues for investment, liquidity, and financial innovation. This article delves into the significance of these platforms, their applications, and the transformative impact they bring to various industries.

The Foundation of Tokenization Platforms

At the core of blockchain tokenization platforms lies the ability to represent real-world assets, such as real estate, art, or commodities, as digital tokens on a blockchain. This process involves converting the value of an asset into tradable tokens, allowing fractional ownership and seamless transferability.

Enhancing Liquidity and Accessibility

One of the primary advantages of blockchain tokenization is the increased liquidity it brings to traditionally illiquid assets. Through tokenization, assets become divisible into smaller, more manageable units, enabling a broader range of investors to participate. This democratization of access to assets is a significant shift in the financial landscape.

Real-world Applications in Real Estate

Real estate is a prominent industry benefiting from blockchain tokenization platforms. Property ownership can be divided into tokens, allowing investors to buy and trade fractions of real estate assets. This not only makes real estate investments more accessible but also enhances liquidity in a historically rigid market.

Tokenization in the Art World

Blockchain tokenization extends its reach to the art world, revolutionizing the way art is bought and sold. Tokenized ownership of artworks enables investors to own a share of valuable pieces, providing exposure to the art market without the need for massive capital. This democratization fosters a more inclusive art investment environment.

Security Token Offerings (STOs) and Compliance

Security Token Offerings (STOs) leverage blockchain tokenization to issue security tokens, which represent ownership in regulated financial assets. Unlike Initial Coin Offerings (ICOs), STOs adhere to regulatory frameworks, providing investors with a compliant and secure investment option.

The Role of Smart Contracts in Tokenization

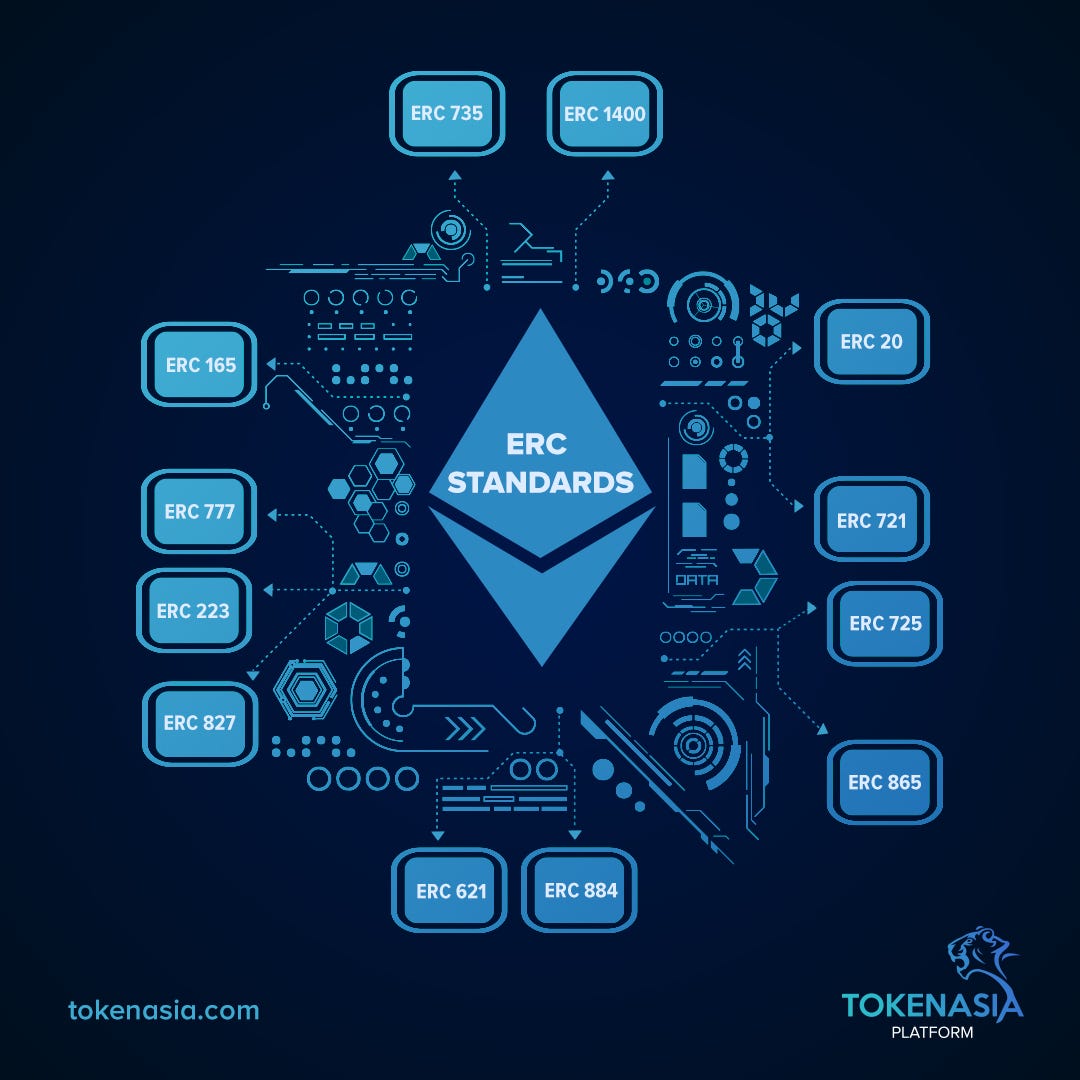

Smart contracts, self-executing contracts with coded rules, play a pivotal role in the functioning of blockchain tokenization platforms. They automate processes such as token issuance, transfer, and compliance, ensuring that the rules governing tokenized assets are transparent, immutable, and executed without the need for intermediaries.

Interoperability and Cross-platform Tokenization

Interoperability is a key consideration in the blockchain space, and tokenization platforms are no exception. Efforts are underway to enable cross-platform tokenization, allowing assets to move seamlessly between different blockchain networks. This interoperability enhances the versatility and reach of tokenized assets.

Challenges and Regulatory Considerations

While blockchain tokenization platforms offer innovative solutions, they face challenges related to regulatory compliance, standardization, and security. Regulatory frameworks are evolving, and the industry must strike a balance between fostering innovation and ensuring investor protection.

Blockchain Tokenization Platforms at fireboyandwatergirlplay.com

For a deeper understanding of blockchain tokenization platforms and their evolving landscape, visit Blockchain Tokenization Platforms. This platform serves as a valuable resource, providing insights, updates, and access to cutting-edge tokenization solutions.

Conclusion: Transforming Ownership and Investment

In conclusion, blockchain tokenization platforms represent a transformative force in the financial and investment landscape. By converting traditional assets into digital tokens, these platforms enhance liquidity, accessibility, and efficiency across various industries. As the technology matures and regulatory frameworks evolve, blockchain tokenization is poised to reshape how we perceive ownership and investment opportunities.