Decentralized Exchanges: Revolutionizing Blockchain Trading

Decentralized Exchanges (DEX) Platforms in Blockchain: Redefining Digital Asset Trading

The landscape of digital asset trading is undergoing a revolutionary transformation with the rise of Decentralized Exchanges (DEX) platforms in the blockchain space. These platforms, built on the principles of decentralization and user empowerment, bring a paradigm shift to the traditional centralized exchange model. In this exploration, we delve into the key features, advantages, and the transformative impact of DEX platforms in the blockchain ecosystem.

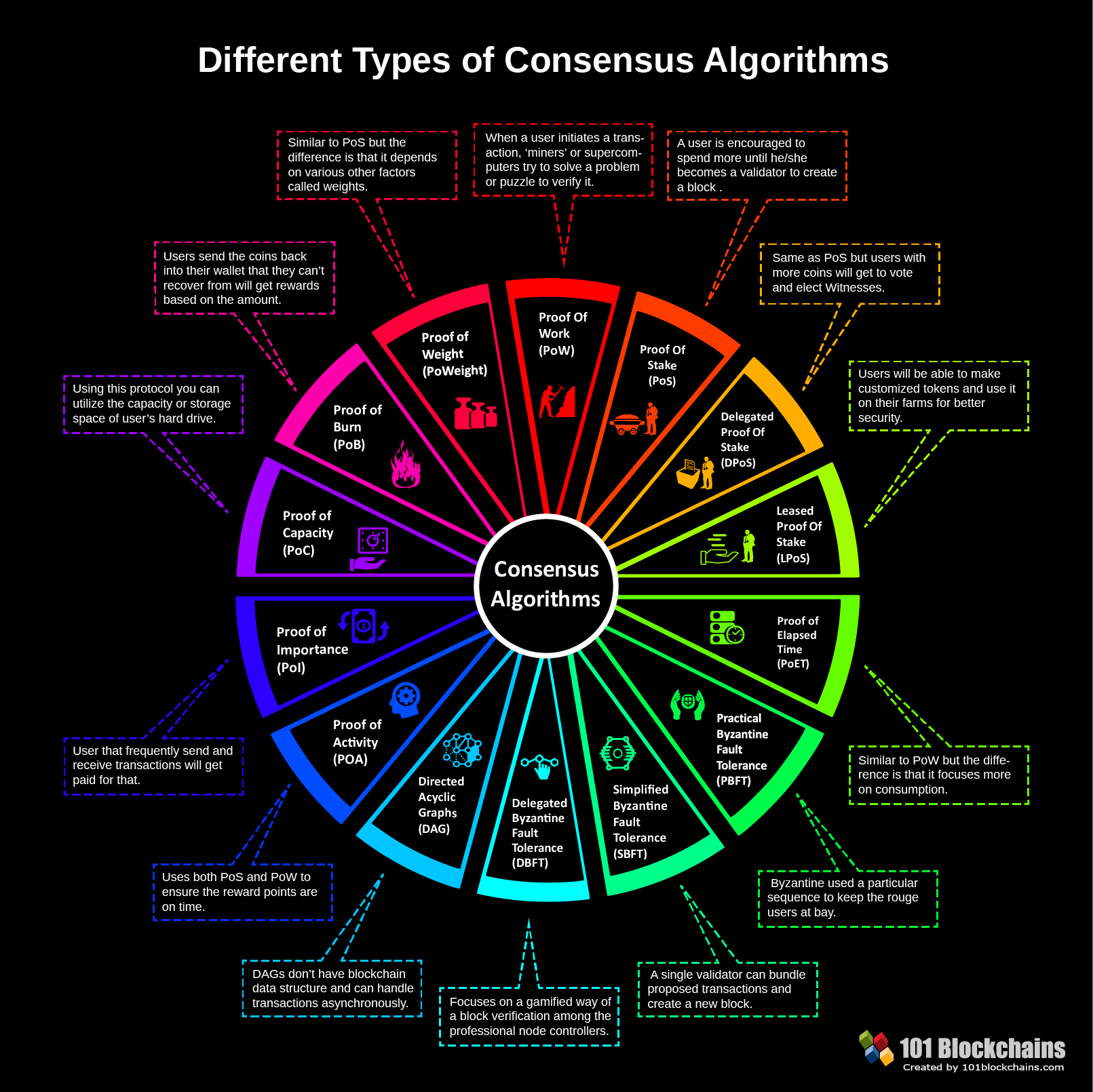

Decentralization at the Core

At the heart of DEX platforms is the principle of decentralization. Unlike centralized exchanges that act as intermediaries and custodians of users’ funds, DEX platforms operate on blockchain networks, leveraging smart contracts to facilitate peer-to-peer trading. This decentralized architecture eliminates the need for a central authority, providing users with greater control over their assets and reducing the risk of hacking or mismanagement.

Empowering User Ownership and Control

One of the significant advantages of DEX platforms is the emphasis on user ownership and control. In a DEX, users retain control of their private keys and funds throughout the trading process. This not only enhances security but also aligns with the core ethos of blockchain technology, where individuals have sovereignty over their assets. The elimination of a central authority reduces the risk of fund freezes or unauthorized access.

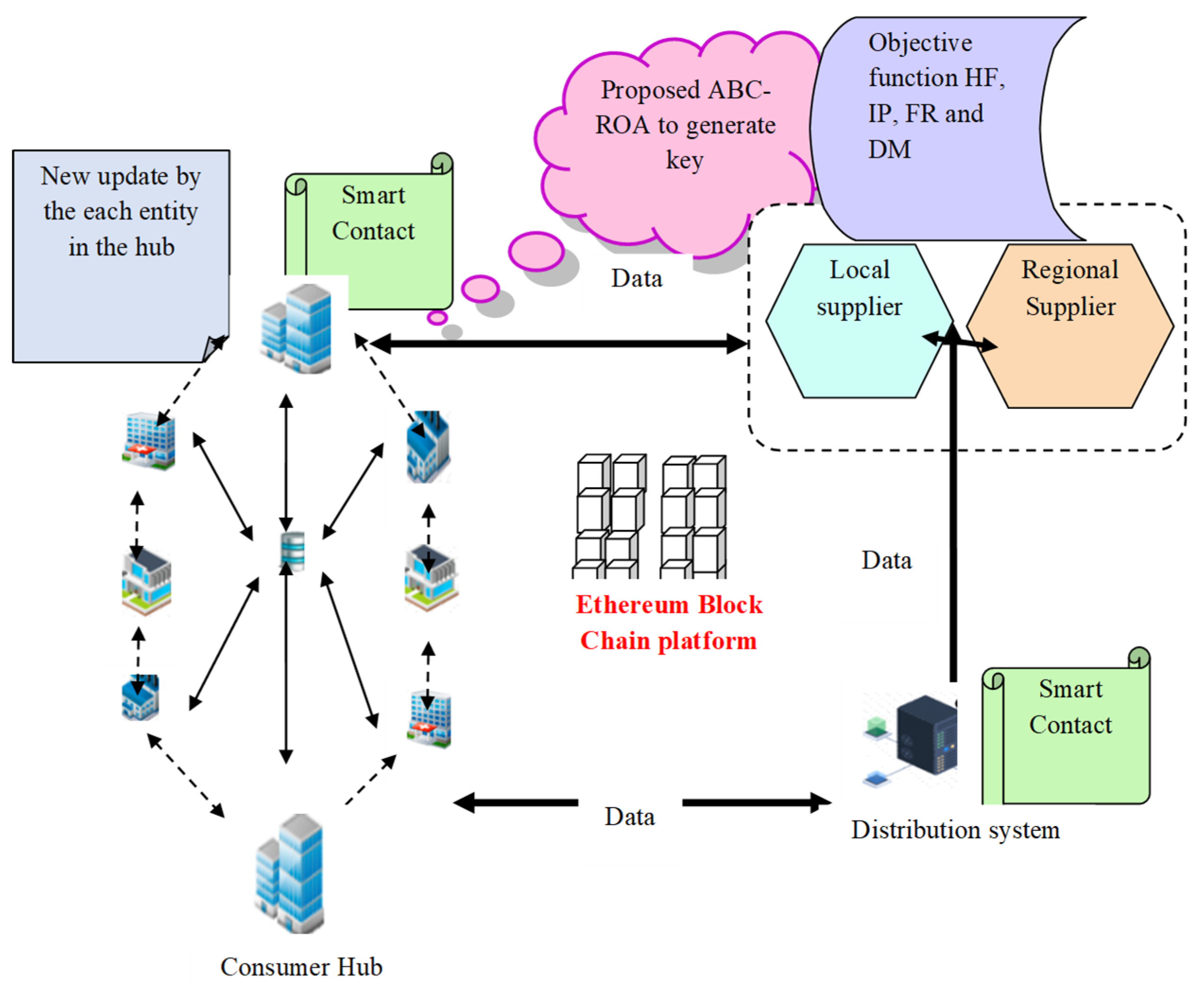

Smart Contracts Facilitating Trades

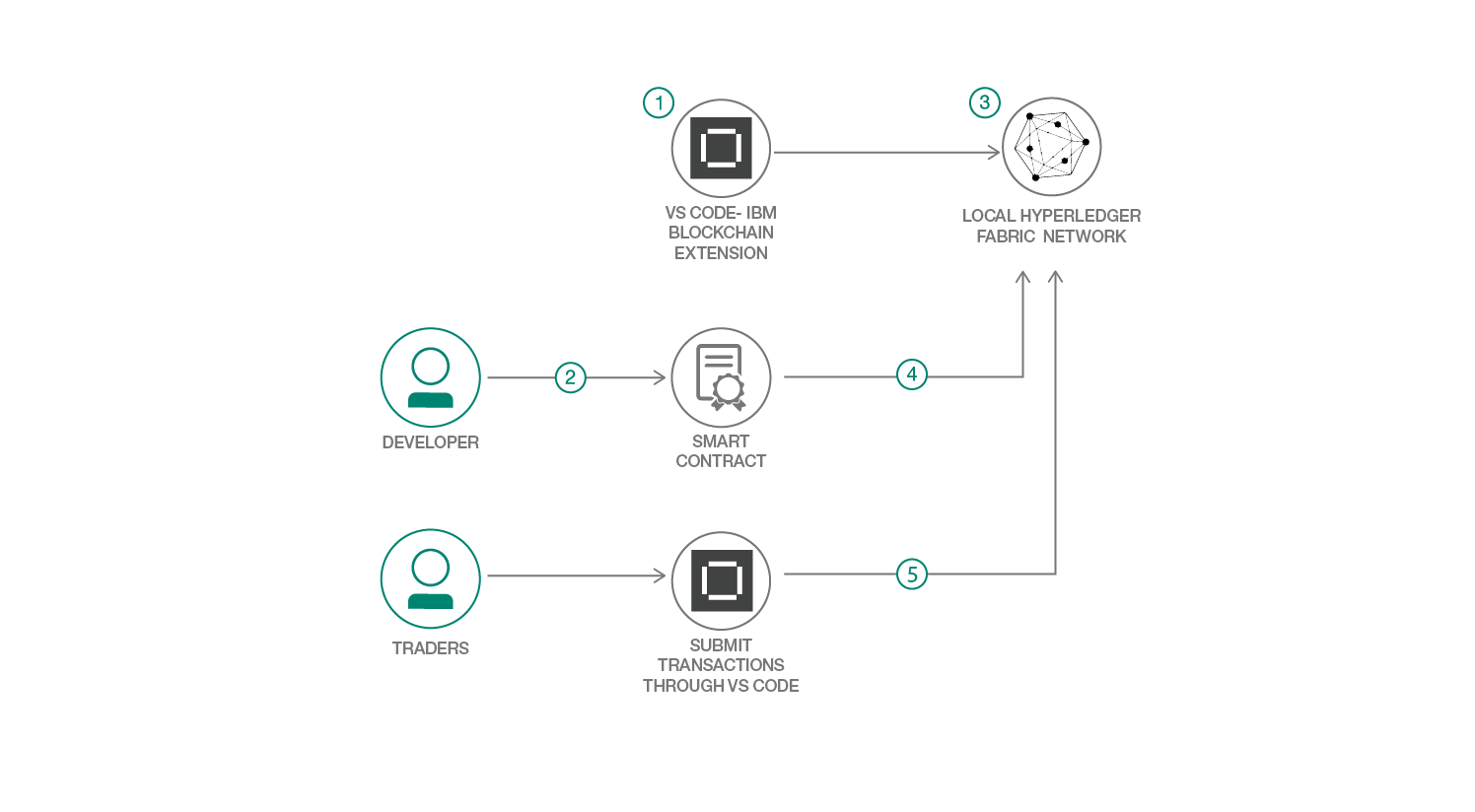

Smart contracts play a pivotal role in DEX platforms by automating and executing trades directly on the blockchain. These self-executing contracts enable the trustless exchange of digital assets, ensuring that trades are settled transparently and securely without the need for an intermediary. The use of smart contracts also contributes to the efficiency of trade execution and reduces the risk of fraud.

Global Accessibility and Inclusivity

DEX platforms promote global accessibility to digital asset trading. As they operate on blockchain networks, users from around the world can participate without geographical restrictions. This inclusivity enhances market liquidity and provides individuals in regions with limited access to traditional financial services an opportunity to engage in digital asset trading. DEX platforms contribute to the democratization of finance.

Reducing Counterparty Risk with On-Chain Settlement

In traditional exchanges, trades often involve an intermediary holding custody of assets until settlement. DEX platforms mitigate counterparty risk by facilitating on-chain settlement through smart contracts. Assets remain in users’ wallets until the moment of trade execution, reducing the vulnerability to counterparty default or exchange insolvency. This trustless settlement process enhances the overall security of the trading experience.

Challenges and Scalability Considerations

While DEX platforms offer compelling advantages, challenges exist, particularly in terms of scalability. As blockchain networks face limitations in transaction throughput, DEX platforms may encounter congestion during periods of high demand. Overcoming scalability challenges is an ongoing area of research and development within the blockchain community to ensure the seamless performance of DEX platforms as adoption continues to grow.

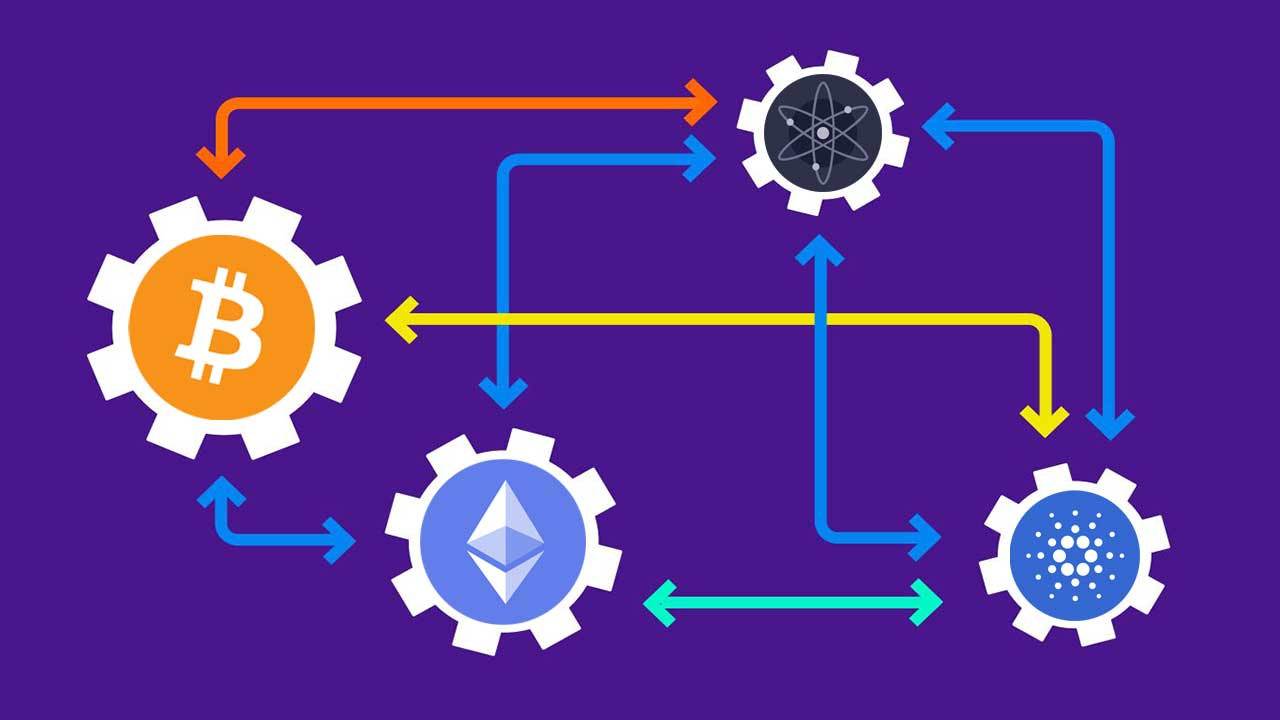

Integration with Decentralized Finance (DeFi) Ecosystem

DEX platforms play a pivotal role in the broader Decentralized Finance (DeFi) ecosystem. The seamless integration of DEX with other decentralized financial services, such as lending protocols, yield farming, and decentralized stablecoins, creates a holistic and interconnected financial infrastructure. This integration contributes to the vibrant and dynamic nature of the decentralized finance space.

User Education and Interface Design

For widespread adoption, user-friendly interfaces and educational efforts are crucial aspects of DEX platforms. As these platforms operate differently from centralized exchanges, providing intuitive interfaces and educational resources helps users navigate the decentralized trading environment. Improving user experience and knowledge empowers a broader audience to participate in decentralized asset trading.

Realizing the Vision of Financial Inclusion

DEX platforms align with the broader vision of financial inclusion by providing a platform for individuals who may be excluded from traditional financial systems. The elimination of intermediaries, lower entry barriers, and the global accessibility of DEX platforms contribute to fostering a more inclusive financial ecosystem. This aligns with the ethos of blockchain technology to create open and accessible financial tools for everyone.

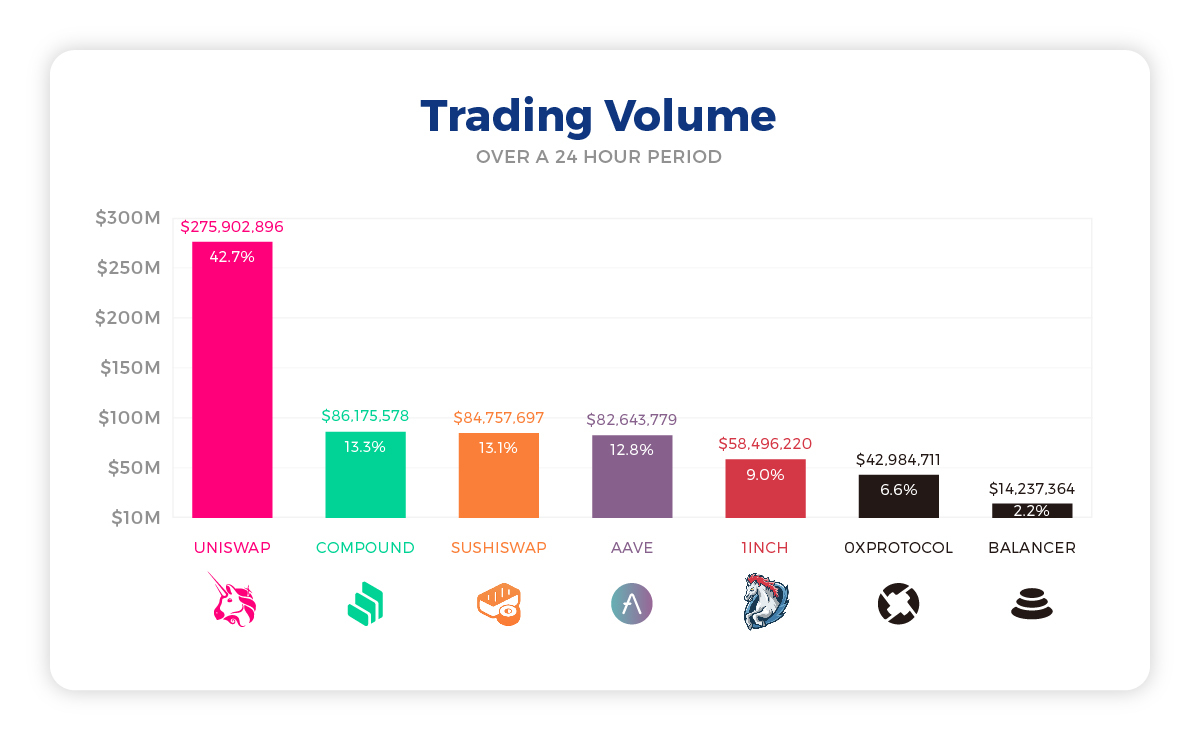

The Future Landscape of DEX Platforms

As the blockchain space continues to evolve, the future landscape of DEX platforms holds immense potential. Ongoing advancements in blockchain technology, scalability solutions, and regulatory developments will likely shape the trajectory of DEX platforms. With growing interest and adoption, DEX platforms are poised to become integral components of the broader digital asset trading ecosystem.

To explore more about the transformative impact of DEX platforms in blockchain, visit DEX Platforms in Blockchain.

In conclusion, Decentralized Exchanges (DEX) platforms in the blockchain space represent a revolutionary shift in how digital assets are traded. By prioritizing decentralization, user empowerment, and global accessibility, DEX platforms contribute to a more secure, inclusive, and user-centric trading experience. As the technology continues to mature, the influence of DEX platforms is expected to play a defining role in the future of digital asset trading.